Hello, business owners! Are you looking for precise steps to register Employee Retention Credit (ERC) in your QuickBooks? Then, this blog has got you covered. Today, we’re diving into the nitty-gritty of how to record ERC in QuickBooks. By following these steps, you can easily register ERC in your payroll software as well as understand the procedure better.

But first, let’s clarify what ERC is. It is a refundable tax credit for eligible employers who kept their employees on payroll during COVID-19-related business closures. Now, onto the recording bit. The ERC is a tax credit, it reduces your tax liability. Therefore, in the income statement, this credit should be recorded as a reduction in tax expenses. Read more about income statement here.

Here’s a simple way to understand this. Let’s suppose you have a $25,000 ERC. You would reduce (debit) your tax expense by $25,000 and increase (credit) your tax payable or refund receivable by the same sum amount. However, there’s a complication. You can only record the ERC when it’s ‘realized’. This means you got the refund or applied it against your tax liability. Until then, we can say it’s a phantom credit – not to be seen in your financial statements.

What are the Benefits of ERC for Employers?

To summarise, eligible employers can benefit from the ERC in the following three ways:

- They can reduce the amount of employment taxes they have to deposit.

- If organizations had an average of 500 or fewer full-time employees in 2019, they can ask for an “advance refund” of the credit they expect to receive for a specific quarter.

- When eligible employers submit their quarterly federal employment tax return, they can request a refund for any credit they haven’t already received as an advance refund. For this, they’ve to file ‘Form 941’. Instead of getting a refund, you can also use the amount to lower tax deposits.

Why Recording ERC in QuickBooks Is Necessary?

As you know many organizations use QuickBooks Payroll to manage their administrative tasks. You may also be aware that businesses claim the Employee Retention Credit (ERC) on their federal payroll tax returns, specifically Form 941. The claim depends on when the payroll costs were paid during the quarter.

Here, for businesses using third-party payroll software like QBO, it’s crucial to implement the credit effectively. They can only do that once their business gets eligible. After that, they can configure their payroll system to track the credit in ‘real-time’ accurately. Recording ERC in QuickBooks is necessary for medium to large businesses as it allows them to:

- Stay compliant with tax regulations

- Report credit on tax filings

- Generate accurate financial reports

- Calculate and claim ERC easily

- Get an accurate audit trail of all transactions

- Simplify payroll processes

- Make expense tracking easier

Setting Up QuickBooks for ERC Recording

Before we begin answering your query – how to record ERC credit in QuickBooks, let’s understand some specifics that you need to do first.

Ensuring QuickBooks is Up-to-Date

The first thing a business should do is keep the software (QuickBooks) updated with the latest features and upgrades.

Making Sure You Qualify for the ERC Credit

One of the best ways to check on your ERC refund eligibility is to call the IRS directly. The IRS has a dedicated helpline number for business i.e. 800-829-1040. When you call, make sure you keep your company’s federal identification number handy.

Setting Up Payroll Settings in QuickBooks to Accept and Track ERC Credit

For your business to get the benefits of ERC, you first need to configure the Payroll settings in QB. The steps to do the same are mentioned below:

1. Log in to your QuickBooks Online account.

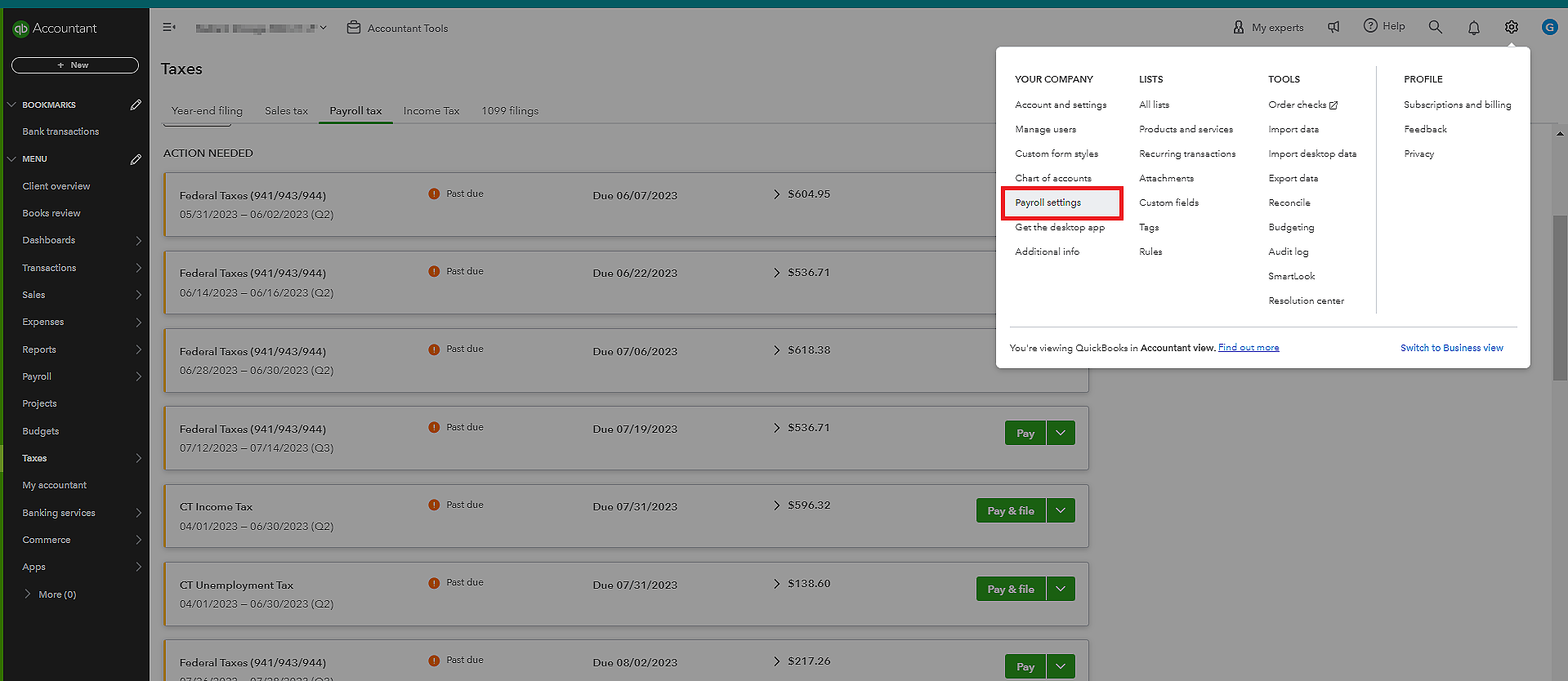

2. Navigate to the top right corner of the dashboard to find the “Gear” icon and then, select “Payroll Settings.”

3. Within the “Payroll Settings” menu, navigate to tax credits.

4. Look for the option to enable the ERC feature.

Note: If you don’t see the ERC option, it is possible that the software is not up-to-date. So, look for any notifications related to it and update QBO accordingly.

5. Provide necessary business information, if needed, to verify the eligibility.

6. Once the feature is activated in QuickBooks, you have to configure the settings so that the software tracks the credits accurately.

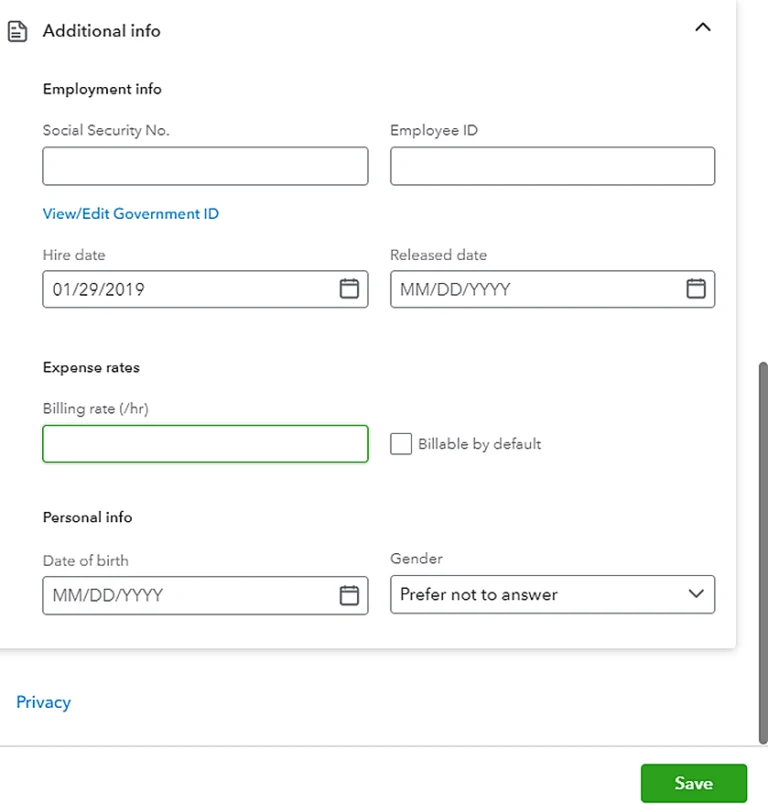

7. Update employee information (steps will be covered next).

8. Save the changes once reviewed.

Setting Up Employees With Pay Types to Get Started with ERC

When businesses ask how to record ERC refunds in QuickBooks, there are certain rules for employees’ wages that they should consider. Employers can only claim a credit against qualified wages paid to eligible employees. That amount varies depending on the period and specific rules set by the IRS. As per the last update, the wage limit is set at the first $10,000 of qualified wages per eligible employee for each calendar quarter in 2021.

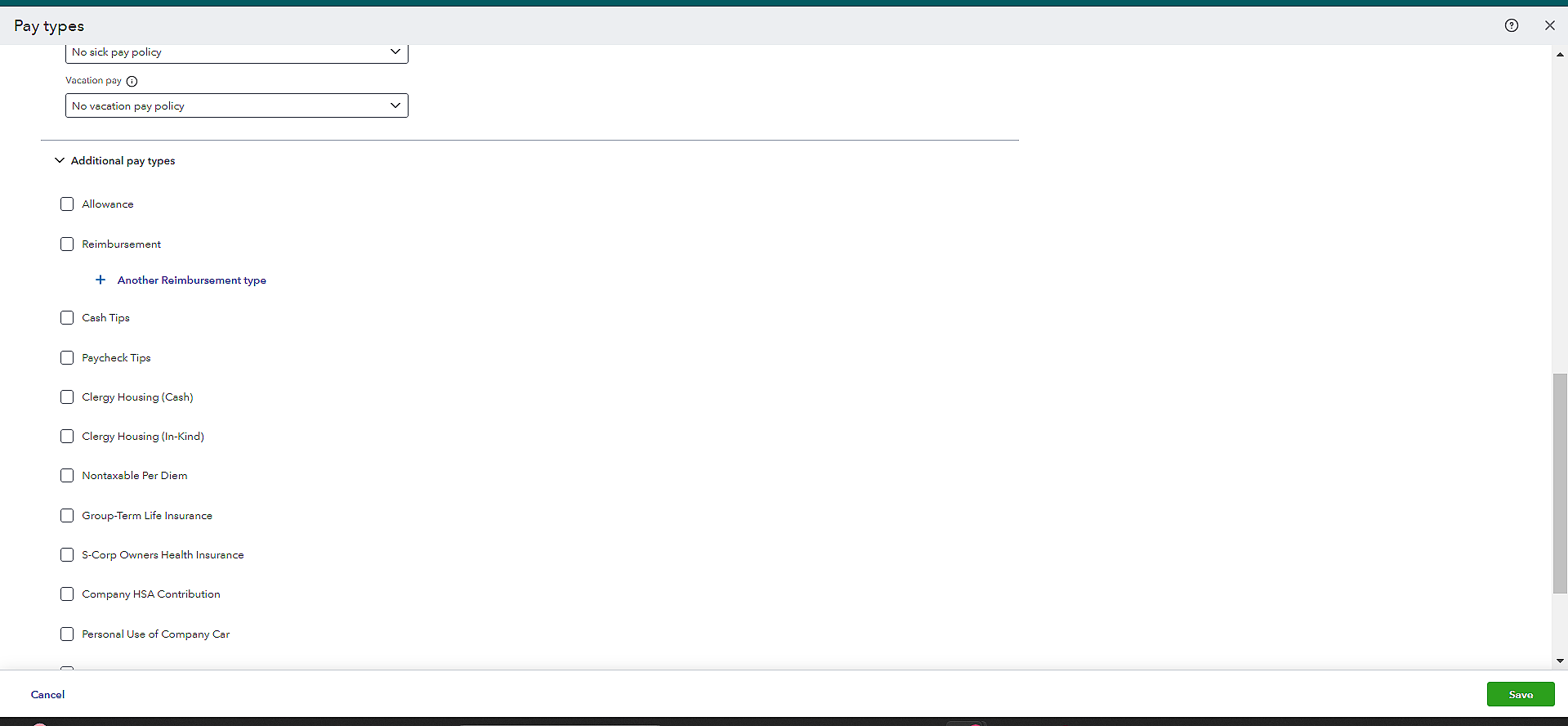

QuickBooks Payroll menu gives organizations the feasibility to set up their employee details easily. Here are the steps you can follow to set up employees with pay types:

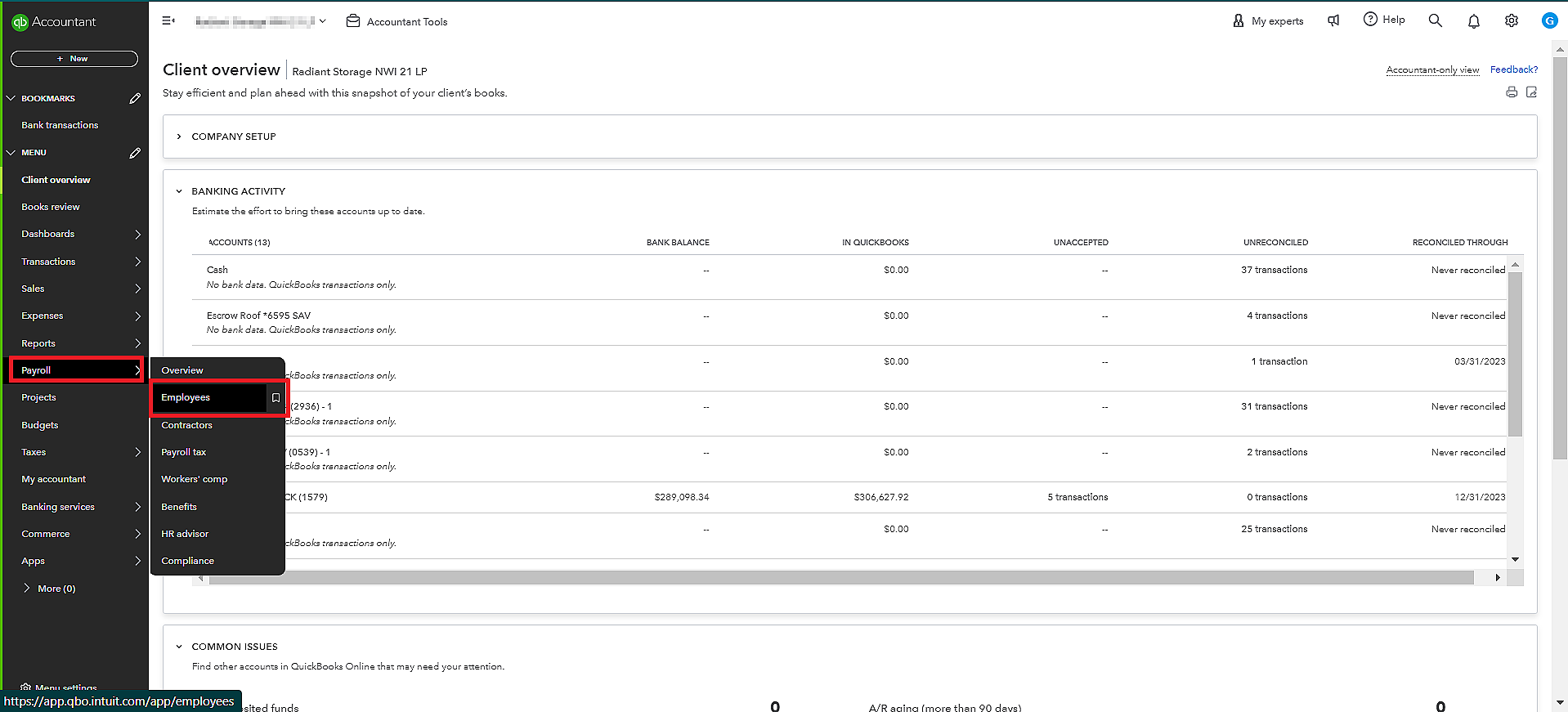

1. Navigate to the “Payroll” menu, then select Employee

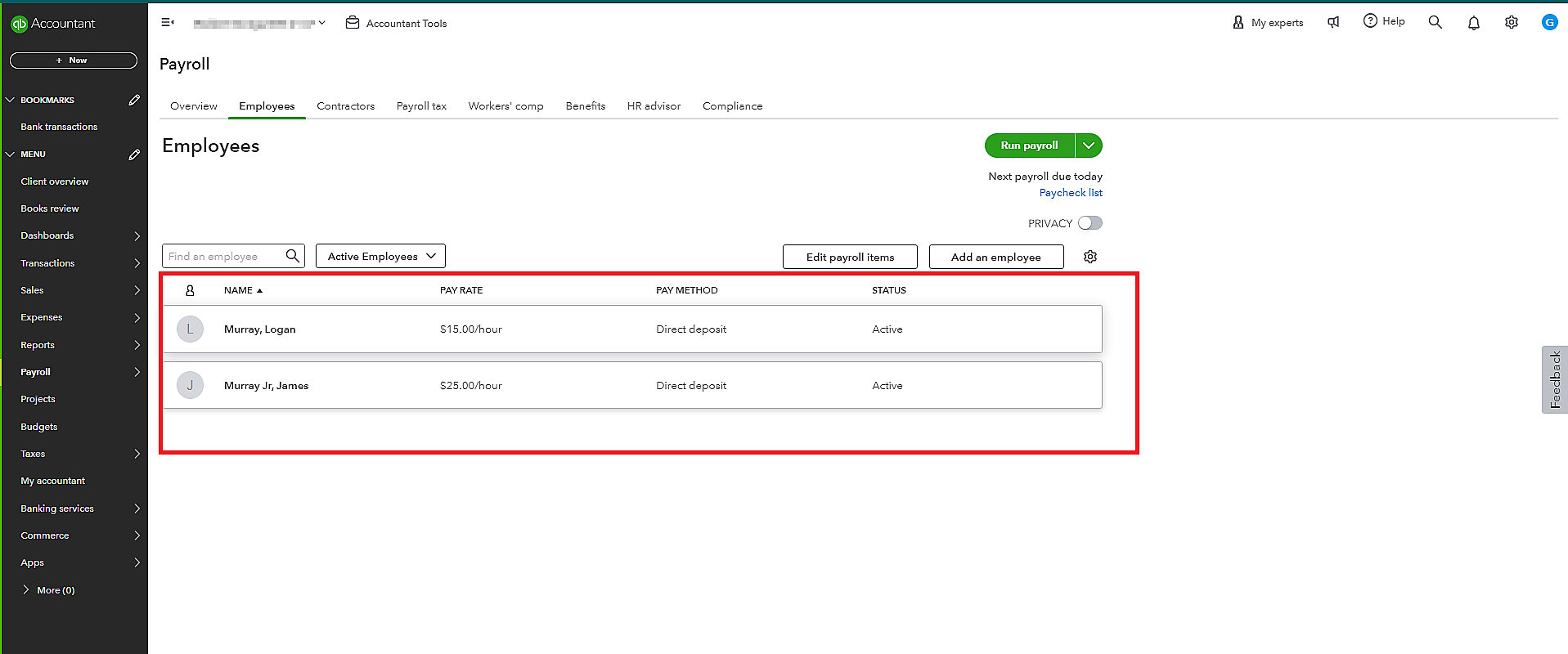

2. Select the employee you’d like to add.

3. Click on the edit icon in the “How much do I pay an employee” section to add more payment types.

4. Apply the pay types that you need under the “CARES Act” section.

5. You can also enter any “Employer Paid Health Insurance Premium” (if applicable) amount to be checked on each payment.

6. Once entered, click on “Done”.

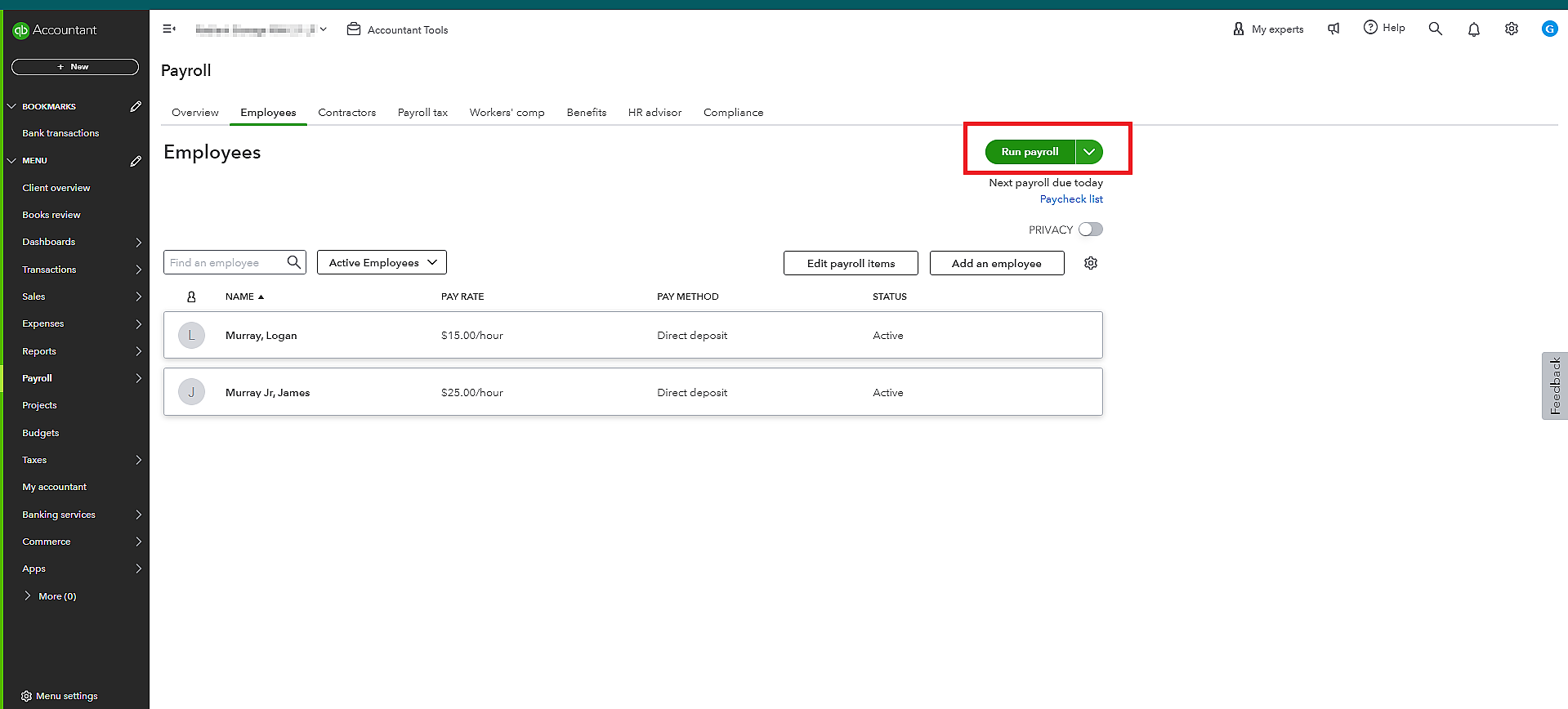

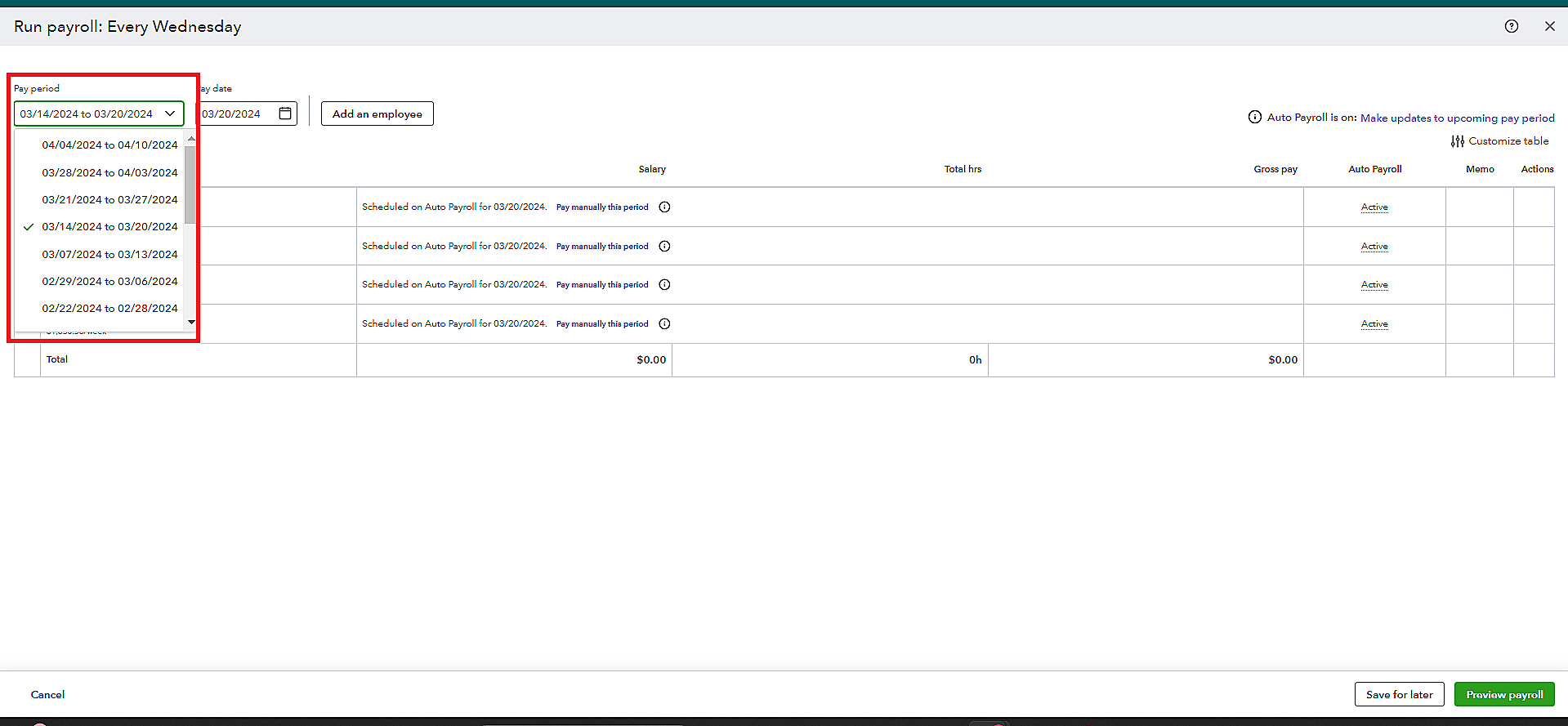

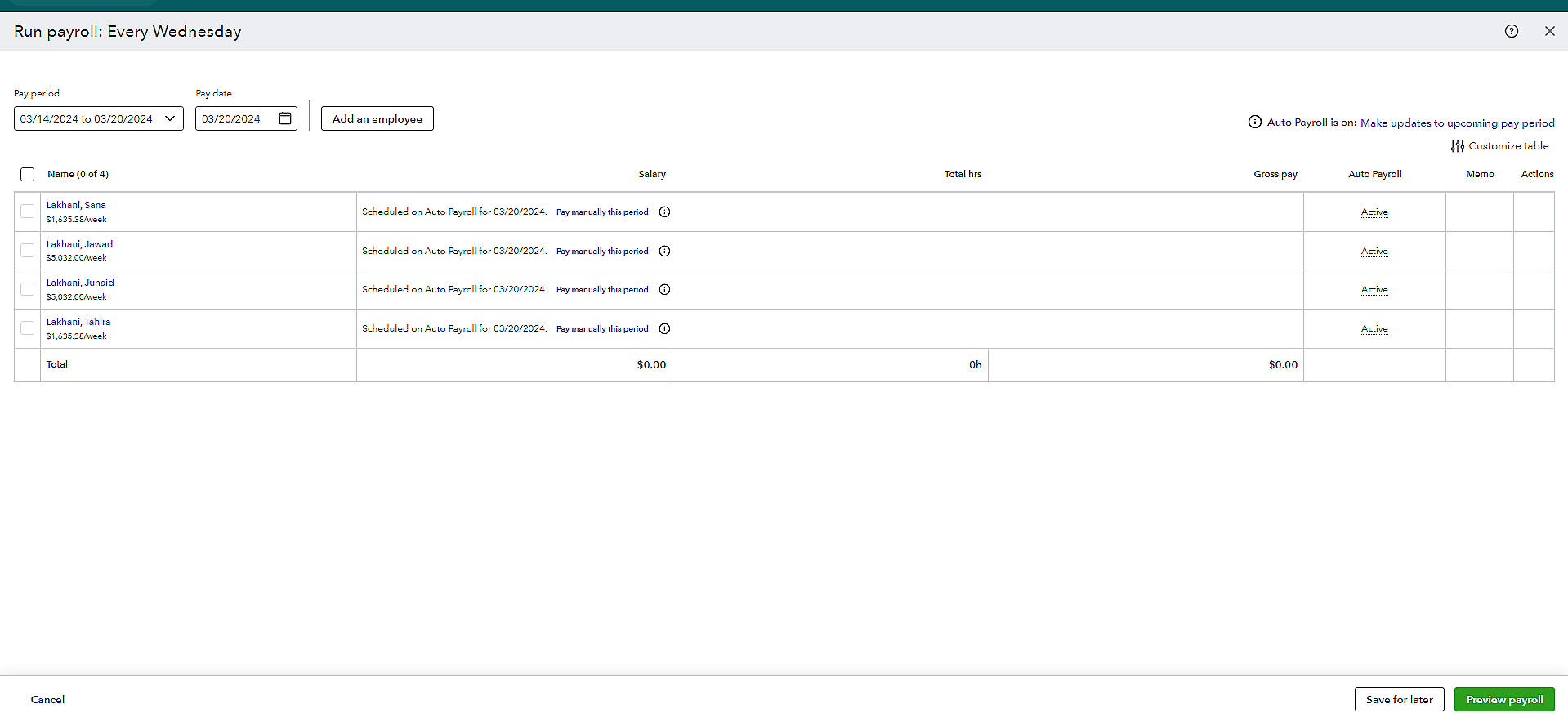

Running your payroll using the pay types

After setting up employees with pay types, it’s time to use the info to run your payroll. Here are the steps to do the same:

1. Select “Run Payroll from the Payroll dashboard”.

2. Select the schedule you are paying if, in case, you have several pay schedules.

3. Enter working hours in the corresponding fields.

4. Add any other information you want to include.

5. Select “Preview Payroll” and then review the paychecks.

6. Finally, select “Submit Payroll”.

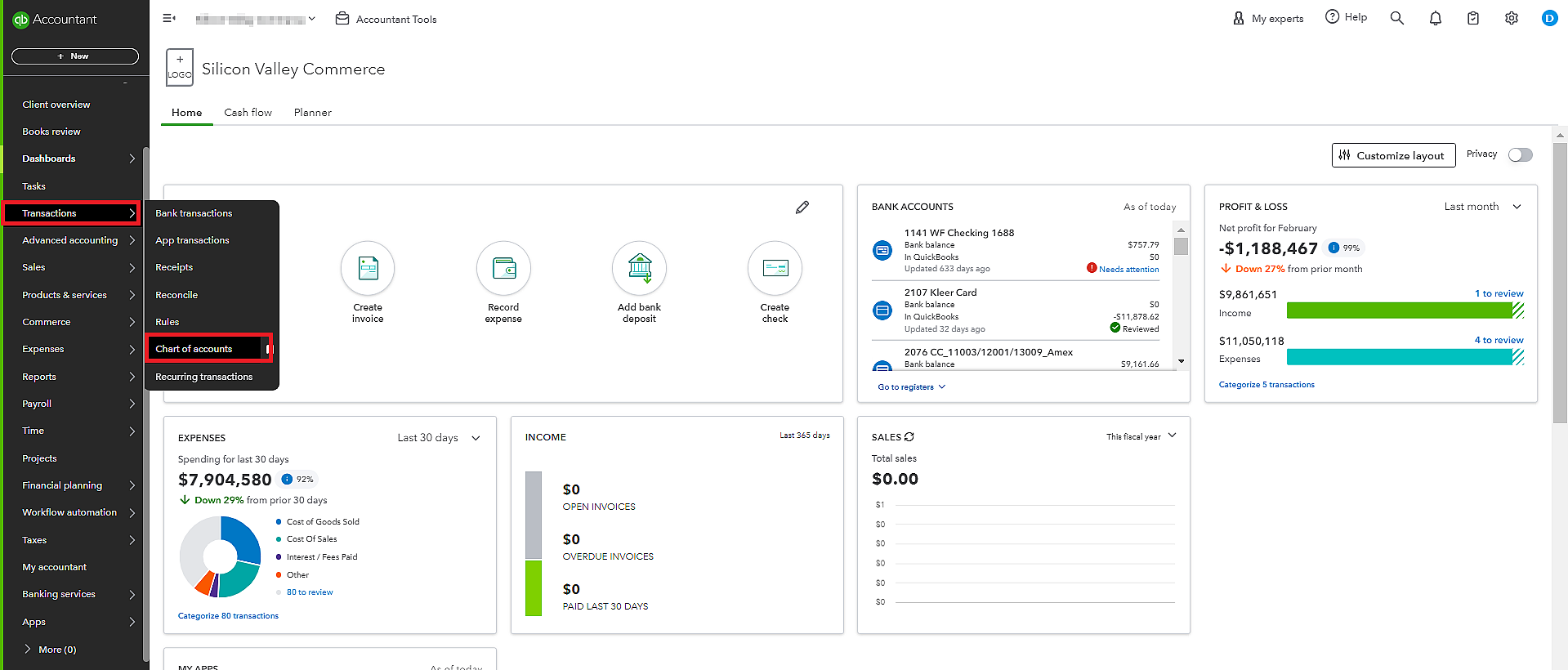

Recording ERC in QuickBooks

Up to this point, we’ve learned about the importance and prerequisites for how to record ERC refunds in QuickBooks online. Now, let’s jump onto the steps of setting the “Employee Retention Credit” in QuickBooks.

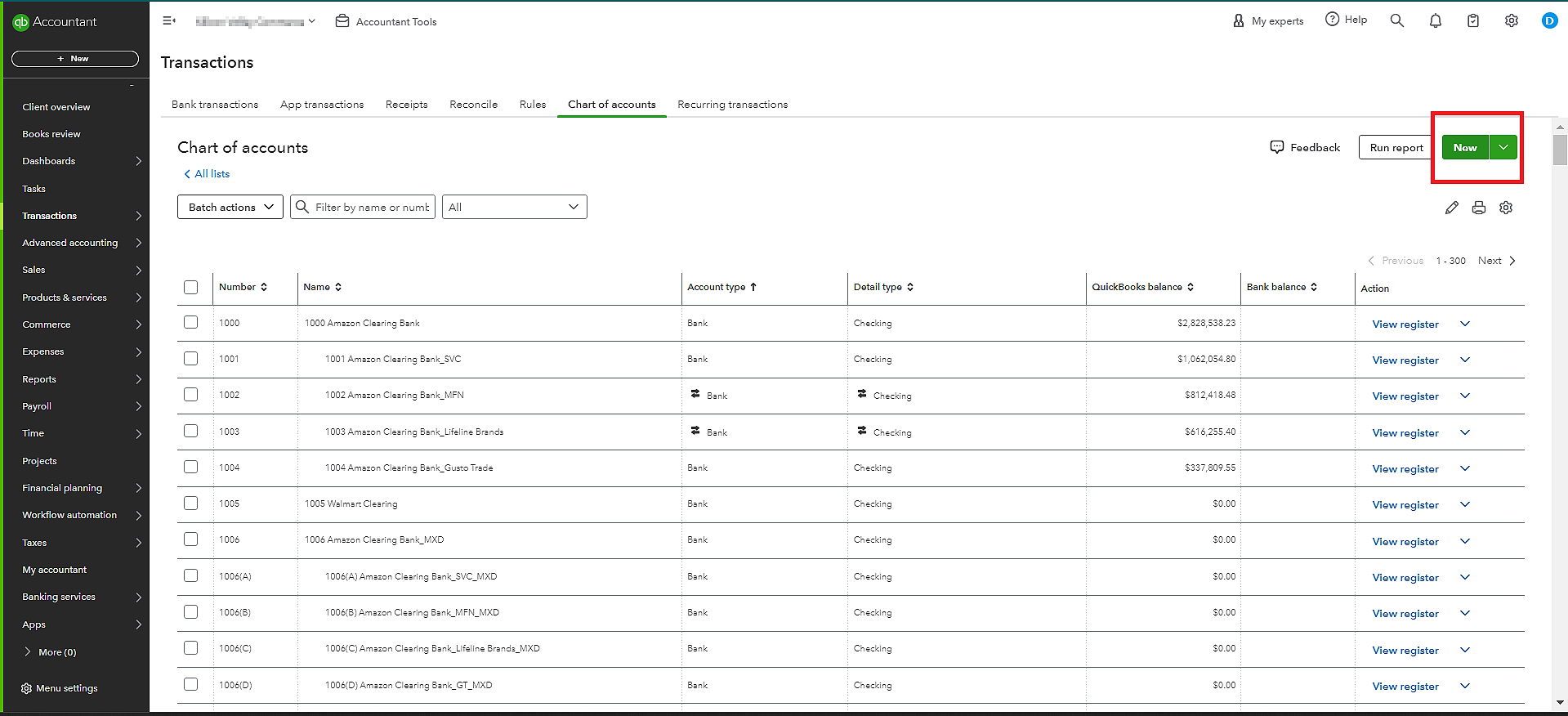

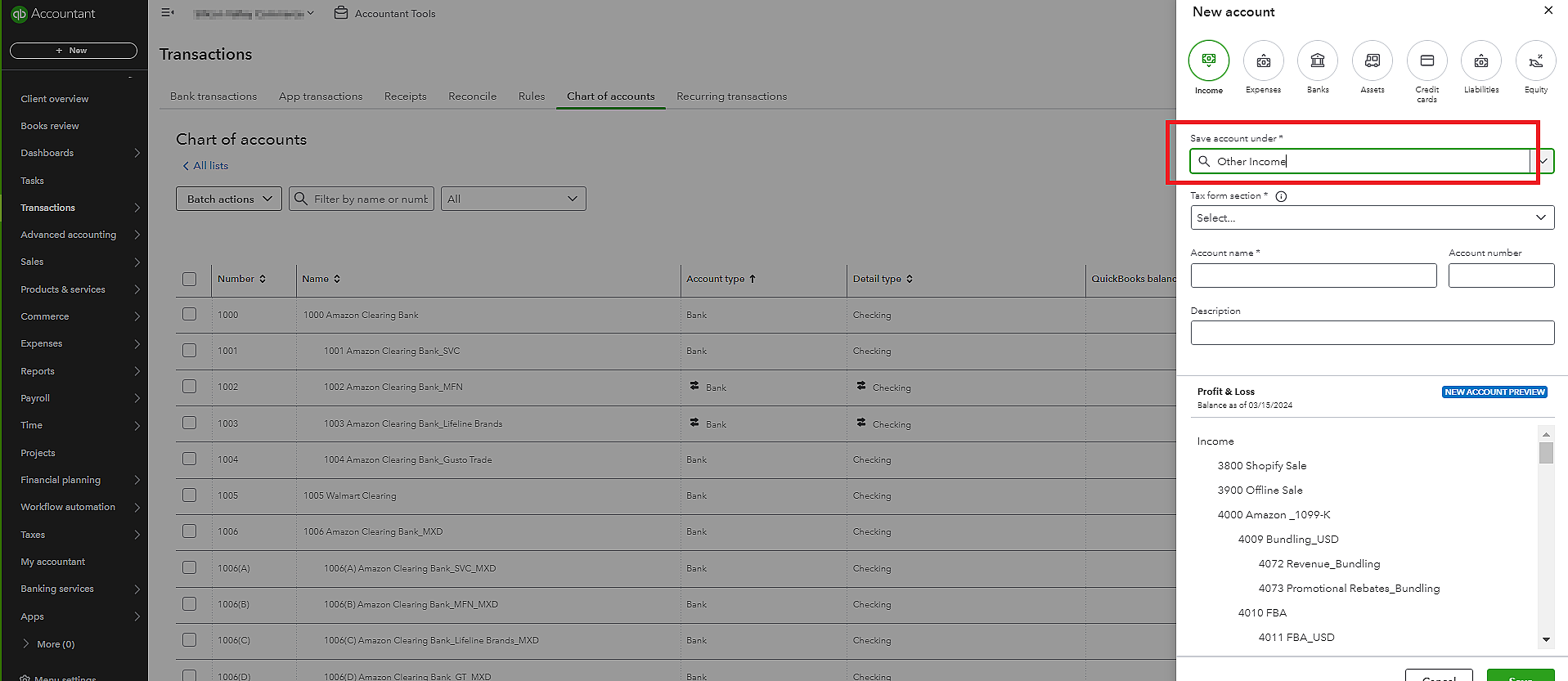

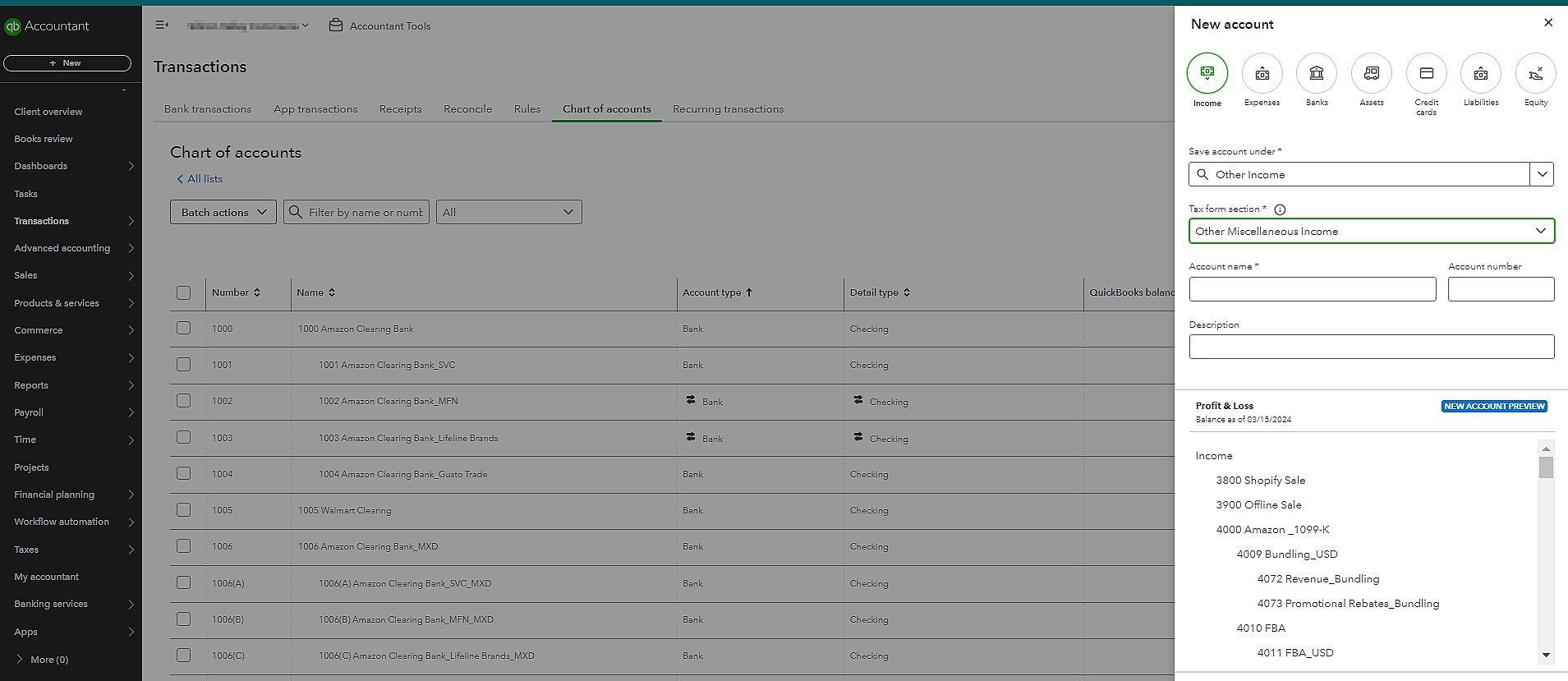

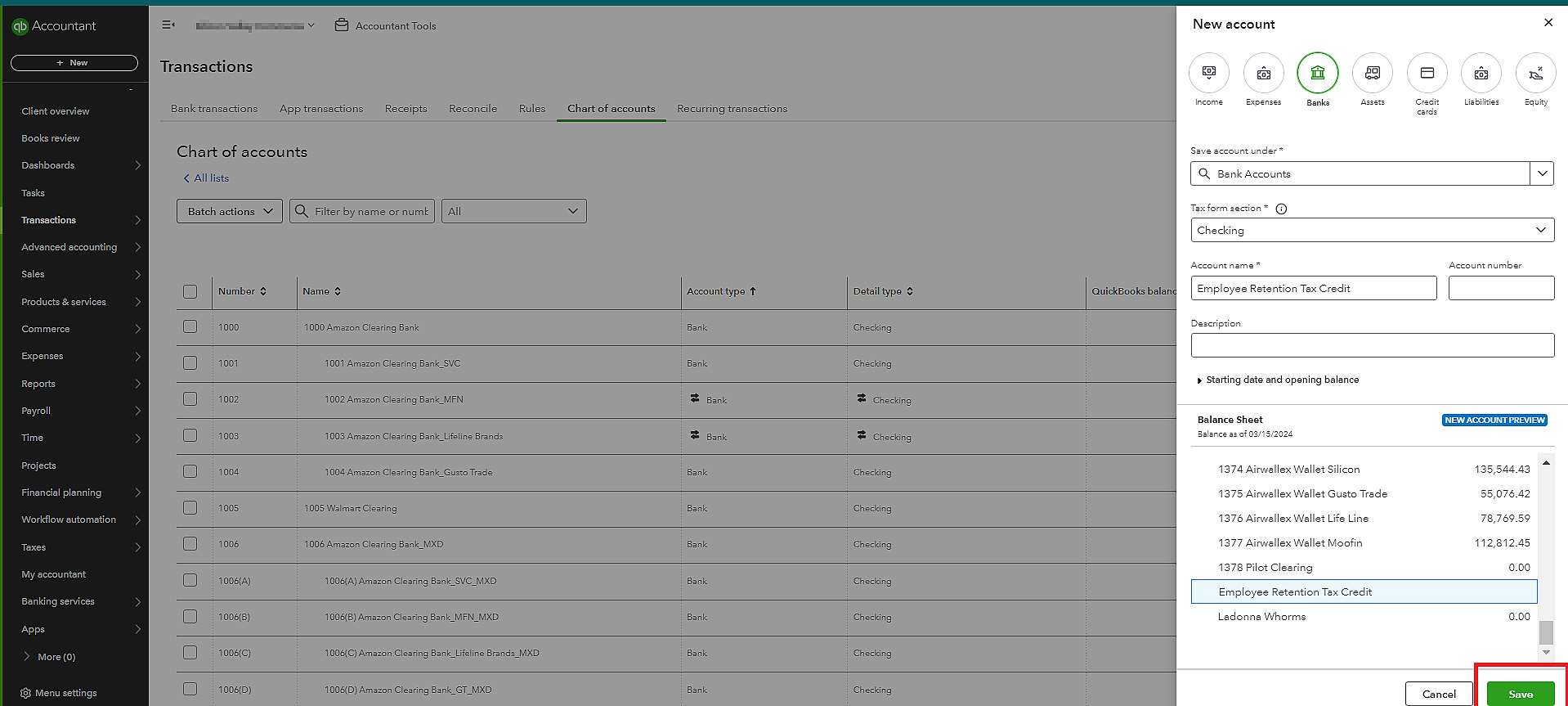

1. Creating an ERC Income Account

You can generate a deposit to record your ERC Credit. First off, a new account has to be created to hold and house this credit. Take a look at the procedure to perform this step:

a) On the dashboard, navigate to “Chart of Accounts”.

b) Click on the “New” button.

c) Select “Other Income Account” under “Account Type”.

d) Select the account type accordingly on the “Detail Type” menu.

e) Add the name of your new bank account. Click on “Save” once entered.

f) Using the account created above, form a new deposit transaction.

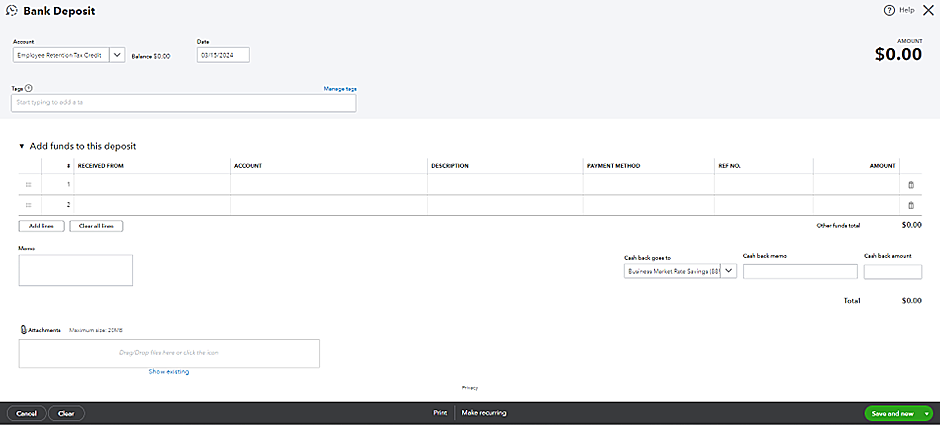

Recording ERC received from the IRS

The next step is to add ERC details received from the IRS on the QuickBooks Banking menu. Here is how you have to proceed.

- Go to the “Banking” menu on QuickBooks and select “Make Deposits.”

- Choose the bank account where you received the ERC funds.

- Enter the date of the deposit and the amount received.

- Add a memo to specify that it’s an ERC refund.

- Save the deposit.

Allocating ERC to specific payroll periods

Recording ERC refunds in QuickBooks involves a series of essential steps to document the tax credit, create accounting entries, and more. One of them is to allocate the credit to specific payroll periods. The steps include:

- Navigate to the Payroll section in QuickBooks.

- Select “Payroll Taxes” and then “Employee Retention Credit (ERC).”

- Enter the payroll period you want to allocate the ERC to.

- Input the amount of ERC to allocate for that period.

- Save the allocation.

- Repeat steps 3-5 for each payroll period you received ERC funds for.

Have questions regarding record ERC in quickbooks

Consult our expert accountants!

Documenting ERC Transactions

So far we’ve understood how to record ERC payments in QuickBooks. Now, let’s look at some measures to keep an accurate record of the transactions. Like other business records, documenting ERC transactions is also crucial. This is because records ensure your organization’s compliance with IRS regulations. It also acts as evidence of an employer’s eligibility for the credit.

Understanding the importance of accurate documentation

Apart from adherence to IRS regulations, here are some other benefits of documenting ERC details accurately in QuickBooks:

- Allows easy retrieval of information for audit purposes

- Justifies the claimed credit amount

- Minimizes the risk of discrepancies or errors in financial records

- Provides transparency that instills confidence in regulatory authorities

Creating supporting records for ERC transactions

As explained above, keeping the correct employee data is necessary for acquiring ERC. Frankly speaking, it’s one of the basics to understand the process of how to record ERC refund checks in QuickBooks. The following are the mandates you need to take care of as an employer:

- Record Keeping: Detailed records of eligible wages paid to employees shall be maintained. Which includes information like dates, salary, and supporting documentation such as payroll records and timesheets.

- Calculation of Credit: Document the ERC credit calculation, which includes

- a) Qualified wages

- b) Percentage used to determine the credit amount

- Tax Forms: Keep copies of relevant tax forms, such as Form 941, where the ERC credit is claimed.

- Employee Information: Accurate records of employee eligibility for the ERC, like their status as a qualified employee.

Organizing ERC documentation for audit purposes

Many businesses use electronic systems to store their documents related to ERC securely. It’s by far the safest means if you use a strong password to keep them. When a company organizes its data properly, it smoothens all the other financial-related processes. For example, maintaining an audit trail of ERC transactions helps track the flow of funds, which is essential for making informed decisions.

Reporting ERC in QuickBooks

As much as how documentation is important, timely QuickBooks reports are necessary too. Reporting helps track ERC refunds clearly and concisely. They provide transparency regarding the utilization of the refund amount. Besides, a detailed ERC report helps an organization stay prepared for the audit process, especially for an event like financial audit. Here are some best measures to report ERC in QBO:

- Generating ERC Reports in QuickBooks: The reports include information related to ERC like credits claimed, qualified wages paid to employees, and any other remaining balances.

- Customizing Reports to Track ERC Utilization: You can customize various options in ERC reports as per your requirements.

- Integrating ERC Reporting with Other Financial Reports in QuickBooks: The integration between QuickBooks ERC reports and other financial modules within the software is quite helpful. Such as balance sheets, income statements, and payroll reports. This integration allows businesses to analyze various processes better and make informed decisions.

Reconciling ERC in QuickBooks

Once your organization receives ERC credit from the concerned authority, reconciliation of the bank data in QBO is necessary to maintain financial accuracy. This process will help you identify any discrepancies and resolve them on time. Steps that you need to take for this process are as follows:

Reconciling ERC transactions with IRS records

- Obtain ERC transaction records from the IRS.

- Compare the transactions recorded in QuickBooks with the corresponding records from the IRS to ensure consistency.

- Verify if the total ERC credits for the respective periods claimed in QuickBooks match those reported to the IRS.

Resolving discrepancies and errors in ERC recording

Though we can minimize the frequency of errors with QuickBooks, they are unavoidable. Thankfully, QuickBooks lets its users find and resolve such discrepancies easily. If there’s an incorrect calculation or missing documentation related to ERC, you can investigate their root cause. And accordingly, take corrective measures to resolve them.

Ensuring ERC Balances are Accurately Reflected in QuickBooks

To make certain that your QuickBooks account reflects ERC balances correctly, you should:

- Review the transactions regularly

- Maintain the ERC documentation

- Reconcile ERC transactions in QuickBooks with IRS records

- Provide proper training to staff responsible for recording ERC transactions in QuickBooks

Best Practices for Recording ERC in QuickBooks

Only knowing how to record ERC in QuickBooks will not do much if a company isn’t aware of the ways to thoroughly manage it. Some quick tips to make this process sustainable for your organization are:

1. Regularly reviewing ERC transactions for accuracy

As mentioned above, financial accuracy with ERC transactions is achievable if you review the data regularly. With proper evaluations comes the realization of errors and issues. And timely rectifying those discrepancies can save a lot of time and effort in the future.

2. Keeping accounting teams informed about ERC recording procedures

Your staff and accounting teams know every bit of your business. Therefore, they should understand the procedure of how to record ERC credit in QuickBooks. Your employees should be familiar with ERC eligibility criteria, documents, and so on. Also, since they would be keeping the record, they must undergo proper training for the same.

3. Staying updated on ERC guidance and regulations to ensure compliance

Just as importantly, keep yourself up-to-date with ongoing changes in ERC regulations. So that you can stay compliant with the credit rules set by the IRS. One of the best ways to do so is to review IRS publications, announcements, and FAQs.

Common Challenges With Recording ERC in QuickBooks and their Solutions

Although we’ve clearly mentioned the steps on how to record ERC refunds in QuickBooks in this article, let’s go over some challenges that you might face.

1. Difficulty in determining ERC eligibility:

Challenge: Sometimes employers find ERC eligibility criteria quite confusing. They’re unsure whether their employees and wages are qualified or not.

Solution: You can either consult ERC’s helpline number or consult a tax professional for their help.

2. Complexity in calculating qualified wages:

Challenge: Calculating qualified wages gets difficult, especially when they include health plan expenses and are subject to wage limits.

Solution: The built-in add-ons in QuickBooks can help you. They’re designed to calculate ERC credits automatically.

3. Tracking changes in ERC guidance:

Challenge: Constant changes in ERC guidance can get a little frustrating, leading to confusion and uncertainty about recording procedures.

Solution: Stay updated on ERC guidance by regularly monitoring IRS updates, publications, and announcements.

How to Record ERC in QuickBooks: Final Thought

At last, we would say that recording ERC in QuickBooks is essential for getting the refund. However, please note that the authority will only initiate the payment if you’re eligible for the same. We hope the steps that we’ve mentioned above on how to record ERC payments in QuickBooks will be of some help. Apart from that, throughout this guide, we’ve covered ERC’s eligibility criteria, ways to configure payroll settings, and more.

To further simplify the process, it’s crucial to stay updated on IRS guidance and regulations to maximize the benefits of this scheme. Even proper documentation is required as it offers transparency and simplifies audit preparation. As for challenges you might face while availing yourself of ERC, feel free to refer to our guide for detailed instructions.

Still, if you feel something is beyond your understanding, we’re here to help you. Our QuickBooks experts, at The Ledgers Labs, know the software inside out. Hence, reach out to us to get instant assistance from our team.