There’s absolutely nobody in the room who hasn’t heard the term income statement. However, ask them what it is and what it entails and you will see holes the size of Manhattan in their knowledge. In this post on the income statement cheat sheet, we have covered all there is to know about the topic.

In simple words, an income statement is one of the most vital financial documents a company possesses. It gives analysts, investors, stakeholders, and every person around you a clear snapshot of how well the company is performing over a certain timeline. The goal? The net profit it generates after deducting all the extra costs it is accounted for.

However, there is more to an income statement at ground level. So, without much ado, let’s take a closer look and understand its structure, analysis, components, and every key piece of information necessary for you to know. Read along, because there’s a lot to uncover!

Key Components in the Income Statement Cheat Sheet

There are three major components that you can see on the income statement cheat sheet and you must be aware of them. Here are the key components:

1. Revenue

Take a look at the income statement cheat sheet above and you will find the term revenue. Revenue is basically the total amount of money a business earns from all its business activities. In simple words, it acts like a salary the company receives. Now that you know what revenue literally means, let’s understand its subgroups:

- Sales revenue: This is the amount businesses earn from selling goods and services. For example, assume a retail store that acquires income through selling electronics and clothes.

- Service revenue: This is the amount that comes from offering services. For instance, a consulting firm provides expert consultancy to consumers and generates revenue through it.

- Recurring revenue: This is a predictable, regularly incoming amount from offering ongoing services or subscription models. This model is pretty common among people around the world. For example, consider a Netflix or Amazon subscription that you renew monthly or annually.

All the types of revenue that you see on the list are typically reported separately to give a better insight into where the cash flow is coming from. As a result, this can help you understand the parts of the business that are performing well to date.

2. Expenses

Expenses are the same as the bills we pay, but instead, they are paid to a business. In other words, these are the costs incurred in order to earn revenues. Next time you look at an income statement closely, try hunting down these components:

- Cost of Goods Sold (COGS): It is basically the direct costs associated with producing goods sold by a company.

- Operating expenses: These are the overhead costs that are required to run a business, including but not limited rent, salaries, and utility bills.

- Depreciation: This indicates the gradual reduction in the value of assets a company owns over a period of time. For example, consider pieces of machinery in businesses that slowly lose value with wear and tear.

- Internet expenses: These are costs that are associated with companies borrowing money. One prominent instance is the interest on different loans a business takes.

If you want to manage your expenses effectively for better financial well-being, then your business’s outflows must never overshadow the inflows. Why is it important? Well, because even a high-revenue company can still struggle if it has high expenses.

3. Net income

Look closely at your income statement, do you see the words “net income”? Simply put, net income (or net earnings) is the income the business has left over after deducting all other additional expenses, such as wages, cost of goods, materials required, and taxes.

The formula for net income is:

Net income = Total revenue – Total expenses It is basically the money left over (a.k.a., the “take home” amount) after other costs are deducted. It can be anything from retirement contributions to tax deductions. A positive net income is a significant green signal to stakeholders and investors, while a negative one may signify a severe red flag for the business. Thus, the net income of a business basically shows whether the company is making profits.

Understanding the Structure of Income Statement

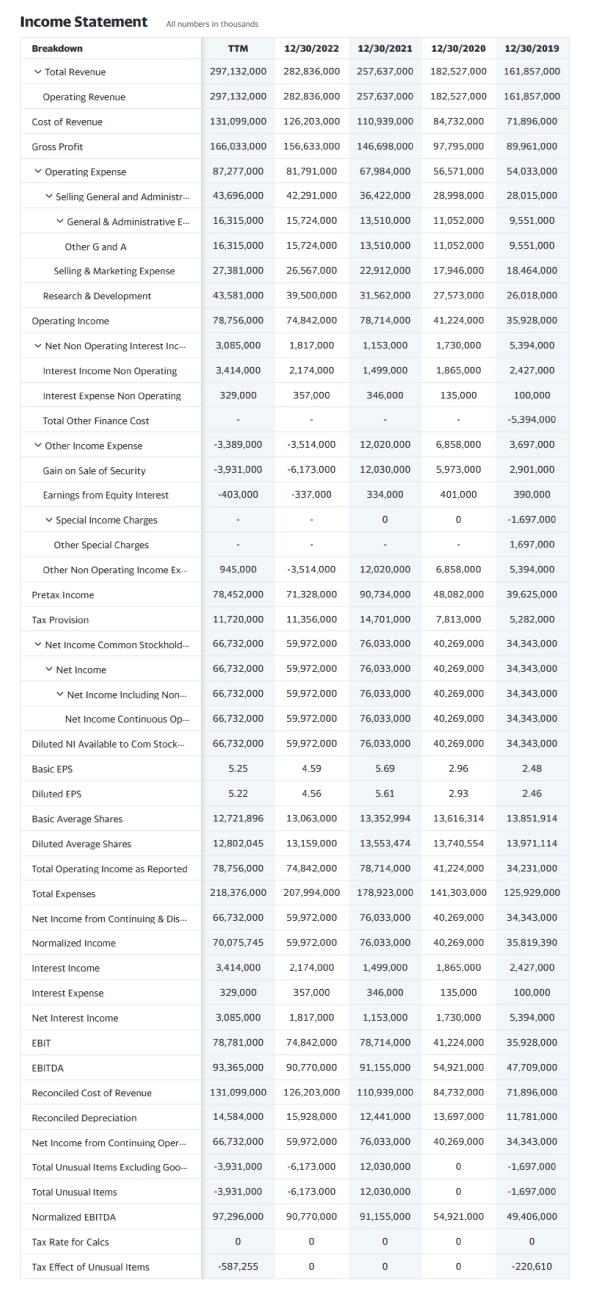

Have you ever seen an income statement? If you have, you’ll know that there are multiple components that are responsible for forming it. Also known as the profit and loss statement, an income statement is an essential financial tool that defines how much money a business has earned and spent over a given time period. Consequently, an income statement follows a very specific structure, as you can see in the below example as well.

Here’s a detailed rundown of what it entails:

1. Revenue sources

In this particular section, you can find comprehensive details of where the company’s income comes from. In other words, it can indicate separate lines for services rendered, sales of products, and interest income.

In general, revenue is represented in a decreasing importance order, wherein the most substantial source is listed at the very beginning. As a result, this gives several stakeholders, analysts, and investors a quick overview of the business’s core model.

2. Cost of goods sold (COGS)

In an income statement, this section indicates the direct costs related to the production of goods and services sold. If you’re a manufacturer, it will include costs like material expenses, cost of labor in production, and other factory utilities. But, do you know how it’s related to revenue? To be more specific, the COGS is deducted from the total revenue in order to evaluate the gross profit. This relationship is especially vital to getting a heads up on the profitability of products or services.

3. Operating expenses

This is where you can focus on all the indirect costs incurred in running the business. Keep in mind that this excludes COGS. In general, this part of an income statement includes wages, rent, marketing, and research & development.

Additionally, operating expenses can further be categorized into various subgroups including selling, general & administrative (SG&A) expenses as well as depreciation and amortization. Now, the question is, how does this information help businesses? This information is vital to analyze particular expenditure areas and pinpointing places where there are major cost-saving opportunities.

4. Other income and expenses

- Non-operating income and expenses: This part of an income statement sheds light on the income that came from investments, profits or losses from the sale of assets, and unanticipated expenditures (legal settlement is one of the most unusual expenditures).

- Impact on net income: Now, this is an important area you need to be aware of too. In simple words, this is the section of an income statement that gives a brief overview of how a company’s non-core activities impact its overall financial well-being.

Need to get help with net income calculation?

Talk to our experts!

Income Statement Cheat Sheet Components Analysis: Key Metrics to Understand

There are several components in the income statement cheat sheet you need to understand to get a full grasp of how a company is performing. In fact, income statement analysis has various financial metrics under its umbrella to help investors and managers get a good view of the company’s financial standpoint. Let’s have a better look:

1. Gross profit margin

Gross profit margin is basically the difference between a company’s revenue and the cost of goods sold (COGS). It can be calculated with the following formula:

Gross profit margin = Gross profit / Revenue x 100 Therefore, this margin is one of the integral metrics that show how efficiently a company has been using its resources in the process of production. To make it more simple, a higher margin usually means greater profitability in the production and sale of goods or services.

2. Operating profit margin

You can determine the operating profit margin by using the following formula:

Operating profit margin = Operating profit / Revenue x 100 Keep in mind that the operating profit is revenue subtracted from COGS and operating expenses.

3. Net profit margin

Net profit is the grand total you receive after you have deducted all additional costs including employee salaries, rent, and taxes, among others.

You can evaluate the net profit margin formula using:

Net profit margin = Net income / Revenue x 100 Hence, this is the margin that gives a full view of the overall profitability a company gains. The higher the net profit margin, the better the chances of converting revenue into raw profits.

4. Earnings per share (EPS)

Earnings per share, or EPS, is pretty self explanatory. In layman’s language, it is the measure of a company’s profitability based on “per share.” This financial metric is essential to investors, analysts, and stakeholders because it sheds light on a company’s profitability. In fact, this is a crucial metric that impacts significant investment decisions.

EPS can be calculated through the following formula:

EPS = Net income / Number of outstanding shares Common Pitfalls to Avoid When Analyzing Elements of Income Statement Cheat Sheet

You might be in trouble if you’re not analyzing all elements of income statement cheat sheet meticulously. While not common among investors and analysts, they can still end up overlooking certain significant aspects, leading to incorrect assumptions about the company’s health. That’s why it is necessary to avoid particular pitfalls at all costs. The list includes:

- Ignoring non-recurring items: Rarely, a business might have one-time expenses, such as the direct sale of an asset or the expenses that piled up due to a lawsuit settlement. As a result, you need to understand that these are not a company’s regular expenditures that happen time and again. Thus, these metrics are usually ignored. If you avoid looking at these numbers, you will get a full picture of the company’s ongoing profitability.

- Failure to consider industry norms: There’s no denying that different industries have several different benchmarks. However, it is better understood with an example, right? For instance, a retail business is nowhere similar to an IT business. Which is why, you need to look at the figures specific to the industry the business is based on.

Therefore, when you analyze elements mentioned in the income statement cheat sheet, it is necessary to compare the business’s figure with its industry average. This is how you get a better picture of how well your business is performing relative to its competitors. - Overlooking changes in accounting policies: Companies, in general, have the power to change their accounting policies due to certain regulatory changes, strategy modifications, and more. These adjustments frequently have an impact on how revenues and expenses are taken into consideration.

In Wrapping Up

The biggest takeaway of studying the income statement cheat sheet is to start looking beyond the numbers. Whether you’re an investor understanding the profitability of a business or an analyst planning for minute future strategies, this statement is actually for everyone trying to get a better view of any company.

As you would have realised by now that every section of the income statement cheat sheet above reveals how the company is doing in the industry and in what ways it can gain more profits. Either way, everything you see in the income statement cheat sheet discloses more than just numbers. It gives you a close-up of your business’s current financial situation.

Have more questions? Get in touch with experts with more than 12 years of experience in this domain. Get instant solutions, practical answers, and thorough guidance – every time.