Have you ever wondered why payroll taxes matter so much to both employers and employees? In simple words, payroll taxes are incredibly essential because they fund several social services, including healthcare and social security. This makes it highly vital and noteworthy to talk about.

For businesses, having a clear understanding of payroll taxes is extremely imperative. Besides, knowing how much money is basically available after these taxes are accounted for is more important than just simply abiding by the law.

Plus, knowing payroll taxes is equally important for employees. Why? Well, this can help them know why their paychecks look the way they do and where exactly their money is going.

Payroll tax resembles a collaboration between employers and workers. Companies deduct a certain amount from an employee’s pay and send it to the government, frequently supplementing it with additional funds. This is a system that benefits everyone involved in the process.

But, that’s not it. There is a lot more to payroll taxes than you realize. Let’s have a close look at what payroll taxes are, what are its types, among many others. So, without much ado, let’s get into it!

Understanding Payroll Tax Calculation

Here’s what you need to follow to calculate payroll taxes:

1. You need to determine certain information:

- a) Employee’s gross pay: This can include any taxable earning, including but not limited to salaries, commissions, bonuses, or wages.

- b) Employee’s withholdings: In this case, it includes pre-tax deductions, such as retirement contributions and health insurance.

- c) Applicable tax rates: In this scenario, it includes federal income tax, Social Security tax, Medicare tax, as well as any state or local taxes. In general, you can always find the current tax rates available from your state’s Department of Revenue or on the IRS website.

2. Evaluate Federal Insurance Contributions Act (FICA) taxes

- a) Social Security tax: In this case, employer and the employee pay 6.2% on their wages. The wage base limit is up to $168,600 as of 2024.

- b) Medicare tax: This is where the employer and employee, both, pay 1.45%.

3. Evaluate Federal Income Tax withholding

In order to determine the withholding rate and the tax bracket, you can use the employee’s taxable income (that is, gross pay minus the pre-tax deductions) alongside the filing status. Moreover, for this same reason, you can leverage IRS tables or online calculators available right at your fingertips.

4. Calculate State and Local Income Tax withholding (in case it is applicable)

It is best to always consult with someone who knows their way around this information. Primarily, not every state has income tax and local tax rates usually vary from one place to another. Have a word with your state and local tax experts to understand certain information and withholding methods. Should you outsource payroll services? Learn more.

5. Calculate total payroll tax

Now, to calculate the total payroll tax, add up all of the withholdings.

6. Calculate employee’s net pay

If you want to determine the employee’s net pay, deduct the entire amount of payroll taxes from their gross pay.

Example of Calculating Payroll Tax

In order to calculate payroll taxes, let’s look at the following example.

Let’s assume Ron Smith’s pay period is bi-weekly with a gross pay of $2,500. Moreover, he has a single filing status with $200 in pre-tax deductions (health insurance). Now that we have the details, let’s calculate his payroll taxes:

Step 1: Evaluate FICA Taxes

Here is how to calculate the social security and Medicare Ron has:

- Social security: $2,500x 6.2% = $155 (this is what both the employer and employee pay)

- Medicare: $2,500 x 1.45% = $36.25 (this is what both the employee and employer pay)

Once you fill in the first step, here’s what you need to do.

Step 2: Evaluate the Federal Income Tax Withholding

Herein, you need to first calculate the taxable income.

Thus, taxable income = $2,500 – $200 = $2,300

Now, on the basis of the IRS tax tables for 2024, we determine that Ron has a 12% withholding rate.

Therefore, the Federal income tax withholding is = $2,300 x 12% = $276

Step 3: Calculate total payroll taxes

Total employee withholdings: Social security + Medicare + Federal income tax

Thus, when we put the number,

Thus, total employee withholdings = $155 + $36.25 + $276 = $467.25

Step 4: Calculate Net Pay

This is typically the last step where you evaluate the net pay.

Here is what you should do:

Net pay = Gross pay – Total withholding

Hence, Net pay = $2,500 – $467.25 = $2,032.75

Moreover, here is the Employer’s share of the payroll taxes:

- For Social Security: Social security = $155 (employee) + $155 (employer) = $310

- For Medicare: Medicare = $36.25 (employee) + $36.25 (employer) = $72.50

Hence, the total employer payroll taxes can be determined by: $310 + $72.50 = $382.50

Unsure about payroll taxes?

Why not seek help from tax experts!

6 different types of payroll taxes

Payroll taxes, as mentioned above, are compulsory deductions employers withhold from the paychecks of employees to fund several government programs. There are several types of payroll taxes that you should be aware of. Here is a thorough list that includes all the names you must know about:

- Social Security taxes: These are the types of taxes that help fund the Social Security program. In addition, it benefits retirees, surviving employees of deceased workers, and the disabled.

- Medicare taxes: This is used to fund the Medicare program. In simple words, the Medicare program involves health insurance for those aged 65 or more, and for several younger individuals who have disabilities.

- Federal Income taxes: Even though it does not constitute a certain type of payroll tax, federal income taxes are deducted from the paychecks of employees on the basis of their earnings and filing status. Most essentially, these taxes help fund various government services and programs.

- State and Local taxes: In the United States, there are a number of states and some localities that have their own set of income taxes on wages. In fact, the rates and rules for these taxes actually vary as per different locations.

- Unemployment taxes: Among the many you just read, this type funds the unemployment insurance program. In the Federal Unemployment Tax Act (FUTA) tax, eligible workers receive benefits in case they have lost their jobs not due to their fault. In this case, employers tend to pay 6% on the initial $7,000 of the wages to every worker yearly, in addition to a possible credit for state unemployment insurance contributions.

- Other forms of deductions: On the basis of certain employment agreements and location, many can avail of several other forms of deductions. This can include anything from workers’ compensation to disability insurance, among numerous others. Read about post tax deductions here.

Employers are completely responsible for withholding an accurate amount of tax from the paychecks of their employees. Not to mention, they are also equally responsible for paying these taxes to the appropriate government bodies.

But, what if they happen to fail to do any of that? The answer is pretty simple. Failure to withhold payroll taxes properly or completely neglect their pay can lead to substantial penalties for employers.

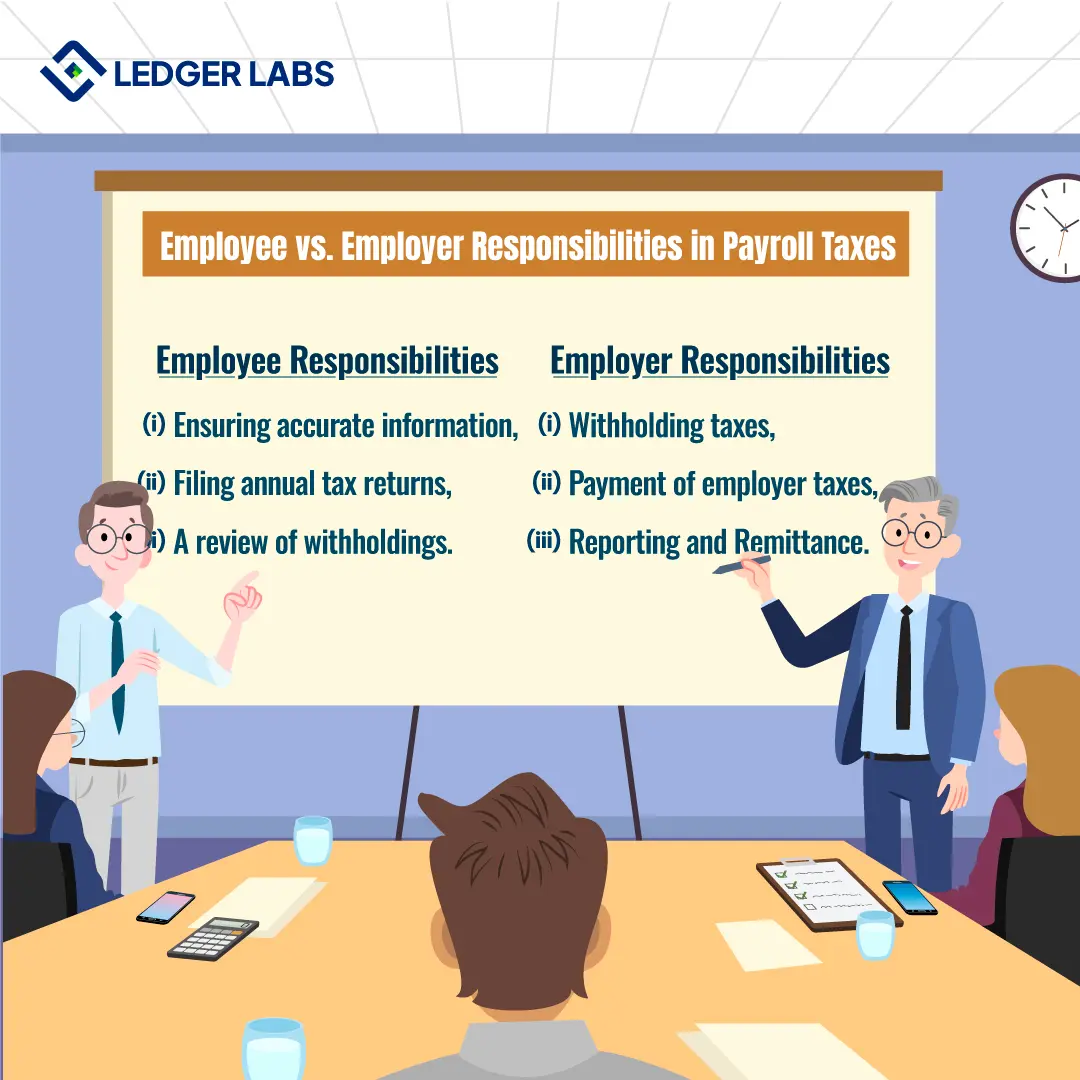

Employee and Employer Responsibilities in Payroll Taxes

The roles specific to employers and employees in payroll taxes involve certain guidelines they need to look at in order to stay compliant with the law. Here’s a better look to understand who is responsible for what duties:

Employee’s Responsibilities:

- Ensuring Accurate Information: Employees need to stay clean on their slates and provide employers with justifiable information about their records, including their Social Security number and filing status. This is usually done via a form like the W-4.

- Filing Annual Tax Returns: Employees, typically, have to file their own annual tax returns with tax authorities like the Internal Revenue Service (IRS). This is the procedure for reconciling the tax that is withheld from their wages or salaries for the year in addition to their actual tax liability.

- A Review of Withholdings: Employees must always go through their pay stubs to make sure the withheld amount is correct. In case their situation somehow modifies in the near future (let’s say they got married or had children), in that case, they may need to update their withholding information with their respective employers.

Now, let’s list down the responsibilities shared by the employers.

Employer’s Responsibilities

- Withholding taxes: In this case, the employers should withhold the right amount of taxes from the wages or salaries of their employees. Now, this largely involves anything between Social Security taxes, Medicare taxes, and Federal and State Income taxes. These are important figures as they help employers evaluate withholdings.

- Payment of Employer taxes: Apart from withholding taxes from the paychecks of employees, employers also need to pay their fair share of payroll taxes. This includes paying for any employer-related taxes to the respective authorities.

- Reporting and Remittance: Just like employees, employers need to report the taxes they are responsible for withholding alongside their personal payroll tax contributions to the government.

Furthermore, this entails filing the Employer’s Quarterly Federal Tax Return (a.k.a., Form 941), the Employer’s Annual Federal Unemployment Tax Return (a.k.a., Form 940), and remitting the withheld taxes to the Internal Revenue Service (IRS).

4 Tips for Managing Payroll Taxes

Payroll taxes are important for any business, regardless of large or small. Here are some imperative tips that you can leverage to manage payroll taxes and possibly mitigate liabilities:

1. Start using a payroll software: Having a reliable payroll software solution can be one of the best decisions you can take now. Why? Well, they are among the best for updating tax rates, producing reports, and, in fact, submitting timely payments to tax authorities. This can minimize the chances of errors you make manually and also guarantee compliance. Are you from Saas industry? Read more about Saas accounting software for payroll management among many other functions.

2. Have a word with tax professionals: There is absolutely no doubt that tax professionals can give you major insights about several tax laws and regulations specific to different locations. What’s more? They can identify opportunities to save big on taxes that you would probably not even notice.

Stuck with payroll and want to save tax?

Talk to our tax experts.

3. Always have accurate records: Always maintain records of all payroll activities, including but not limited to employer contributions, deductions, gross wages, withholdings, etc. This is especially imperative for auditing purposes, helping resolve discrepancies.

4. Regularly conduct in-house audits: When you review your payroll procedures and records periodically, you have an early heads-up on recognizing possible discrepancies and inefficiencies. Doing this can help you avoid expensive errors later in the day. Read more about financial audits here.

Changes and Updates in Payroll Tax Rates

As of today, here are some of the updates on payroll tax rates that you should know about:

- There have been no changes to FICA: For the Federal Insurance Contributions Act (FICA), the rates have not altered. In other words, both employer and employee contribution rates are stuck at 1.45% for Medicare and 6.2% for Social security.

- FUTA tax rates did not change: The Federal Unemployment Tax Act (FUTA) is at 6% and has not been through any change, as of now.

- Individual states might have changed: Make sure you check the state’s Department of Revenue website to stay in loop with any changes in payroll tax rates.

- Wage base limit: While it’s true that tax rates have not undergone any change, the maximum wage amount for Social Security typically climbs every year. This year, in 2024, it stands at $168,600.

In Wrapping up

By now, it’s pretty clear that payroll taxes are just as important to employees, as it is to employers. Moreover, they cover several contributions, including Social Security taxes and Medicare taxes, unemployment taxes, federal and state income taxes – just to name a few of the many.

However, you should know that one of the primary responsibilities of handling these taxes falls on the shoulders of employers. Do you know why? Because they are the ones to withhold, report, and also remit payroll taxes on behalf of their workers. That is one of the many reasons why you should always pay extra attention to these taxes to ensure compliance and avoid the risk of penalties. In turn, this helps your business and employees stay financially sound in the long run.

Still have some unanswered questions about what is payroll tax? We can help. Get in touch with our in-house experts with more than 12 years of experience. All your questions are now answered in just one place. So, don’t wait and ring those who know the system from the inside.

Frequently Asked Questions

1.What’s the difference between payroll and income taxes?

While payroll taxes are a shared responsibility of both employees and employers to fund government programs such as Social security and Medicare, income taxes are what only employees pay for general government operations. More so, payroll taxes have a fixed percentage applicable to wages and salaries. On the other hand, income taxes are based on brackets and deductions.

2. What percentage is payroll tax?

Here are some percentages you should be aware of:

- a) Social security: For both employer and employee, it is 6.2%. The wage limit, in this case, is up to $168,600.

- b) Medicare: While this has no wage limit, the percentage is 1.45% for both employer and employee.

- c) FUTA: An employer’s FUTA is 6% (based on the first $7,000 of an employee’s yearly salary, along with possible credits)

- d) SUTA: SUTA basically differs by state and experience rating.

3. Is there a payroll tax refund?

Well, not really. In simple words, employees may acquire tax credits on their income tax return for specific withheld payroll taxes.

4. What is the payroll tax for Social Security?

First of all, this is what both an employee and their employer pay. It is basically 6.2% of your wages. Moreover, this is a program that helps to find retirement benefits, among many more.

5. What is Form 941?

Employers generally use Form 941 to report and deposit the federal income tax and FICA contributions which are withheld from the paychecks of employees on a quarterly basis. Moreover, it also has certain due dates throughout the year.