The Internal Revenue Service (IRS) has finally started to act on the rising inflation rates experienced by every taxpayer around the nation. In fact, they have proposed to address and adjust the income tax brackets for 2024.

Not to mention, the IRS is now planning to lower your taxable income. Wonder why? They want to put your earnings back in your wallet.

Now that the tax season is almost looming around, let’s focus on 2023 and 2024 tax brackets, as well as what you need to know about each of them. As a matter of fact, the IRS has started updating 2024 income tax rates.

The IRS updates its brackets and rates almost every year to show a change in the economy. In this blog post, let’s dive in and understand all the tax rates and tax brackets 2024 updated by the IRS for different areas around the United States.

Ready to know all the nitty-gritty? You’re in the right place. Continue reading to find out everything there is to learn about income tax rates and tax brackets! So, without further ado, let’s cut to the chase.

How to work out which tax bracket you fall in?

If you want to evaluate your tax amount due, start by dividing your earnings into several sections that will be taxes as per the appropriate bracket. As you may already know, tax rates are known to differ.

Now, go on to make a couple of deductions from the gross income to get the adjusted gross income (AGI). This is among the very first steps to calculating taxable income.

After you have reached a proper figure, which is the AGI, you can consider any allowed deduction (either itemized or standard deductions) to finally reach the taxable income. Typically, deductions can appear a little more difficult in nature. That is one of the many reasons why taxpayers often claim the standard deduction, which is contingent on their filing status.

Now that you know how to calculate your tax bracket, let us take a closer look at the rates and tax brackets that various US locations fall under.

Mimimize your income tax liability by seeking our tax planners’ advice!

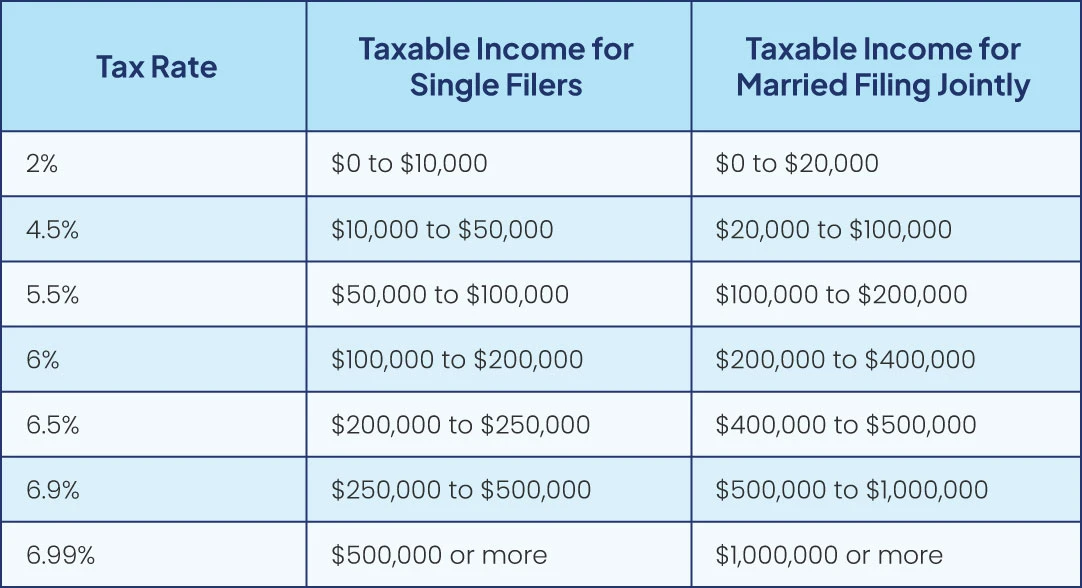

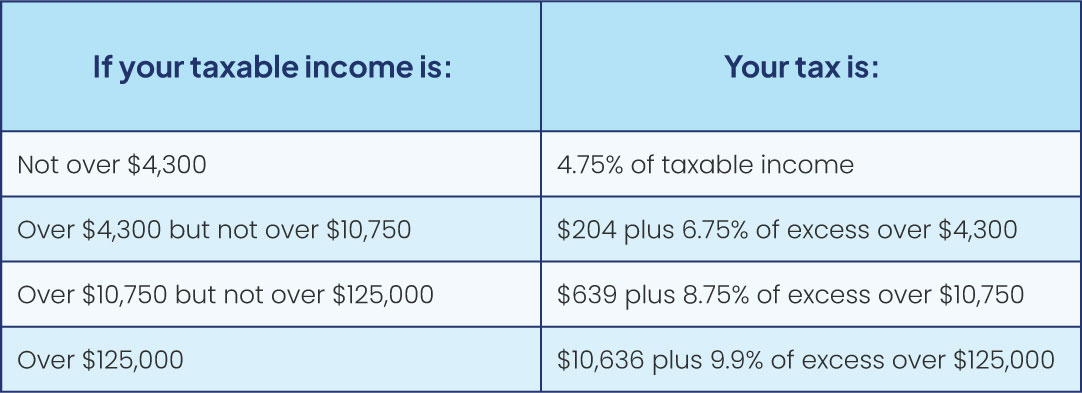

CT Tax Brackets 2024

The Connecticut State Income Tax is basically a state-level tax that is imposed on individuals, businesses, and several other legal bodies. Here’s a rundown to help you understand better:

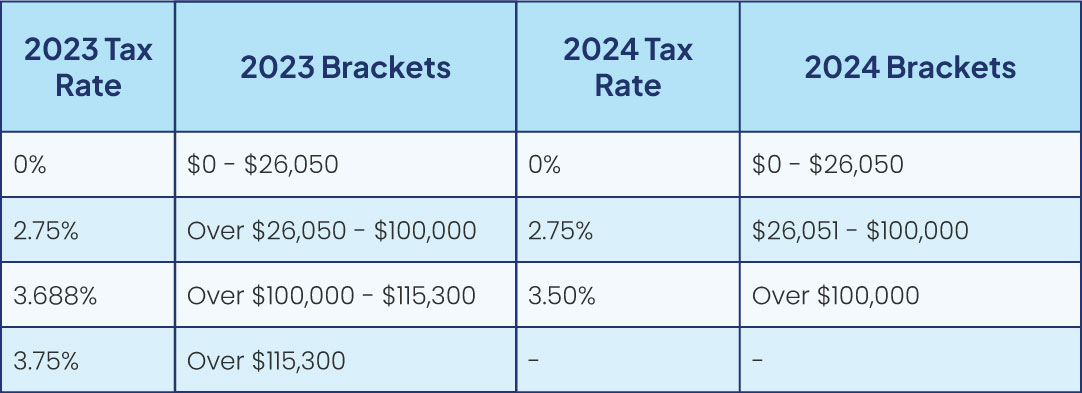

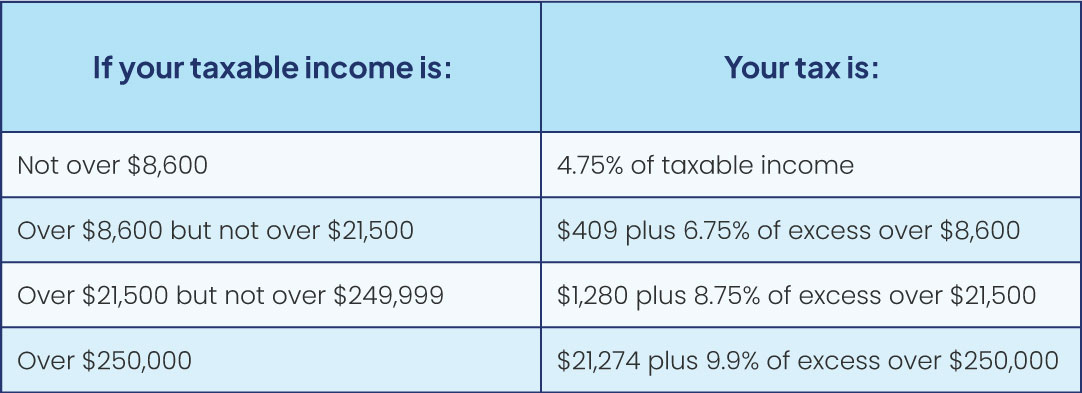

Minnesota 2024 Tax Brackets

The Minnesota Department of Revenue recently rolled out the updated income tax brackets for 2024. As of now, the figures just experienced an adjustment of 5.376 percent as opposed to last year, 2023.

Why the sudden change?

It’s all about making things as fair as possible for people in the U.S. This annual tweak guarantees that you do not end up paying more in taxes just because there is an upward slope due to inflation in your income.

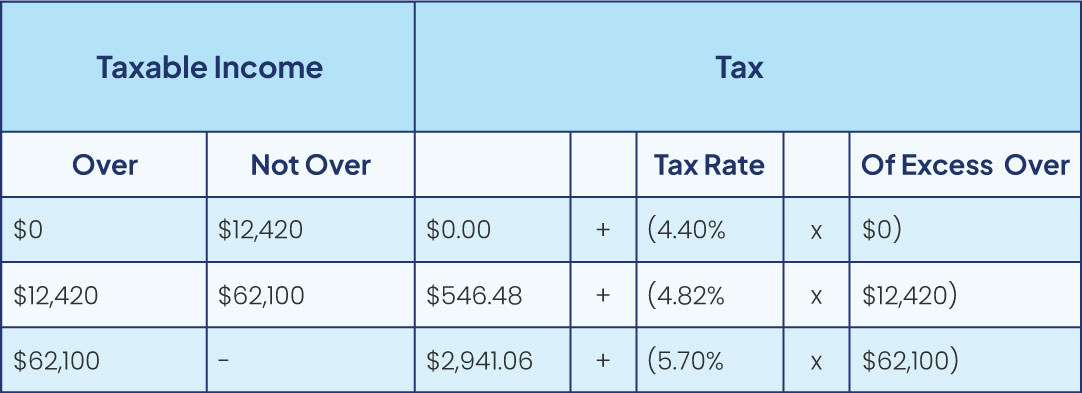

Ohio Tax Brackets 2024

The Ohio individual income tax brackets for the year 2024 are gradually transitioning. Be that as it may, the changes are being phased in more than a two-year period. In essence, here’s a breakdown of what you should expect during the tax season and by the end of the year. Let’s have a detailed look:

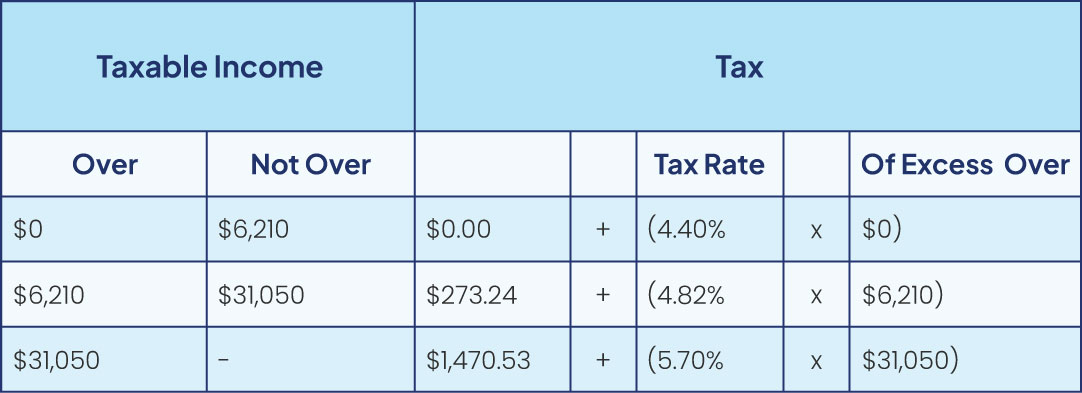

2024 Iowa Tax Brackets

In Iowa, the law has a strategic way of keeping up with the times when it comes down to taxes. Every year, they use a term called, ‘indexation’. In simple words, it boosts up last year’s tax brackets in order to pace up with the rising inflation. You can find it in detail in code sections 422.4 and 422.5.

Ever wondered why they do this? The reason is pretty simple. Their goal is to prevent you from paying additional taxes simply because prices are rising.

Here’s the income tax brackets for 2024 married filing jointly (Iowa tax brackets 2024):

Here’s the income tax bracket for all taxpayers other than married filing jointly:

Iowa has bigger plans down the lane. Precisely, they intend to combine the tax brackets 2024 into two over the course of the next two years.

Oregon 2024 Tax Brackets

The IRS is now adjusting tax brackets for 2024. Moreover, if you look closely at the figures that changed, it has come with higher standard deductions.

Let’s have a look at the tax returns that will be filed in 2025:

- For married couples: In case you are filing jointly, your standard deduction rises to $29,200. That means, it is up by $1,500 from the year 2023.

- For heads of household: Are you the head of household? If you answered yes, your standard deduction will be $21,900 for 2024. It has significantly climbed by $1,100 from 2023.

- For singles and separated: For taxpayers who are either single or separated, you will get a standard deduction of $14,600 for 2024. From 2023, it is $750 more.

The top tax rate remains fixed at 37% for those filing as 2024 IRS tax brackets single taxpayers with an annual income exceeding $609,350. On the other hand, the amount is $731,200 for married couples who are now filing jointly.

Here are the tax rates for single or married filing separately individuals:

Here are the tax rates for married filing jointly, head of household individuals

2024 California Income Tax Brackets

The California income tax actually has nine tax brackets. Moreover, the highest marginal income tax rate is 12.3%. But, this is not as simple as you may think it is. Your income range, alongside the filing status are the determining factors in this case.

In the table below, get a brief glimpse of 2024 California tax brackets for different statuses:

New York, NY State Tax Brackets 2024

The income tax rates in New York State usually range anywhere between 4% to 10.9%, fully depending on factors such as filing status, taxable income, and adjusted gross income. Now, the table below represents everything you need to know about the NY State tax brackets for 2024.

- Married Filing Jointly NYC Tax Brackets

- a) Earning less than $21,600: 3.078%

- b) Earning between $21,600 and $45,000: $665 plus 3.762% of the excess over $21,600

- c) Earning between $45,000 and $90,000: $1,545 plus 3.819% of the excess over $45,000

- d) Earning over $90,000: $3,264 plus 3.876% of the excess over $90,000

- Single or Married Filing Separately NYC Tax Brackets

- a) Earning less than $12,000: 3.078

- b) Earning between $12,000 and $25,000: $369 plus 3.762% of the excess over $12,000

- c) Earning between $25,000 and $50,000: $858 plus 3.819% of the excess over $25,000

d) Earning more than $50,000: $1,813 plus 3.867% of the excess over $50,000

Confused about your state’s tax bracket list?

Get help from our tax experts.

D.C. Tax Brackets 2024

Here is a comprehensive sneak peek into the D.C. tax brackets for 2024 that you should most definitely be aware of:

- Your tax is 4.0% of your taxable income in case it surpasses $0 but not $10,000.

- Your tax is $400 + 6.0% of the amount over $10,000 in case it surpasses $10,000 but not over $40,000.

- Your tax is $2,200 + 6.5% of the amount over $40,000 in case your taxable income is more than $40,000 but not over $60,000.

- Your tax is $3,500 + 8.5% of the amount over $60,000 in case your taxable income exceeds $60,000 but does not go over $250,000.

- Your tax is $19,650 + 9.25% of the amount over $250,000 in case your taxable income is more than $250,000 but not $500,000.

- Your tax is $42,775 + 9.75% of the amount over $500,000 in case your taxable income surpasses $500,000 but does not go over $1 million.

- Your tax is $91,525 + 10.75% of the amount exceeding $1 million in case your taxable income is greater than that threshold.

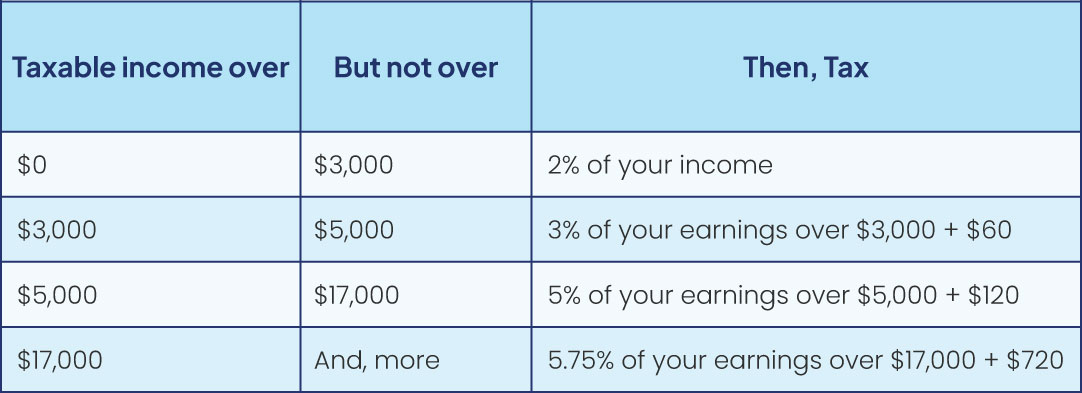

2024 Virginia Tax Brackets

Are you a resident of Virginia or earn from a Virginia-based source? If you answered yes, then you are obligated to pay your fair share in taxes, no matter what. So, let’s go through the income tax bracket for 2024 Virginia. Be aware of your tax liabilities, deductions, and credit. Here’s a rundown of Virginia Income tax brackets and rates for all filing statuses:

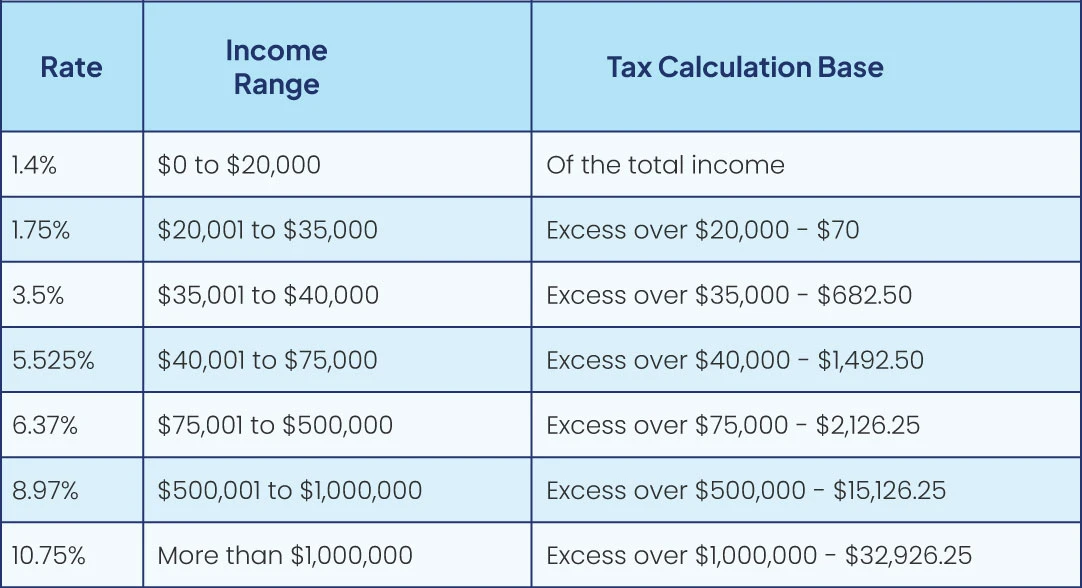

2024 NJ Tax Brackets

Are you a resident of New Jersey or have an income source in the state? If yes, you need to pay state taxes. Sometimes, in order to lower how much you owe, New Jersey allows you to cut down on specific costs, such as alimony payments and medical bills, among many more. But, here’s the thing, just like every state, NJ has its own tax brackets. Here’s what you need to know about it:

Compare 2023 to 2024 Tax Brackets

The income thresholds for all the tax brackets are now raised by approximately 5.4% for the 2024 tax year as opposed to 2023. Why has this been implemented? In order to fight off the gradually climbing inflation around the nation and globe.

This adjustment is intended to account for inflation. As a result, a significant percentage of income may be placed in lower tax brackets for taxpayers whose income has not risen in line with inflation. This has been executed in order to lower their overall tax burden. Besides, it’s important you know that there has been no modification in the actual tax rates from the previous year, which range from 10% to 37%.

In Summing up

It’s rather important to understand your tax brackets and rates at every income level. And, why do we say that? It is because these factors are highly important in evaluating your total tax liability.

The United States is best known for its progressive tax system. Which is one of the major reasons why they have declared to make all necessary adjustments required to face the climbing inflation rate.