Starting a new business comes with a combination of excitement and responsibility. Speaking of responsibilities, business owners have to tackle everything end-to-end, from vendor supplies and funding to operational activities and taxes.

That said, with the constant workload on your shoulders, “taxes” can just add up to the responsibility list. Among all, one of the most important tasks is filing Form 1120, which is the U.S. Corporate Income Tax Return. This form is typically 6 pages long and requires detailed financial information about your business. It is basically the Internal Revenue Service (IRS) that asks for the information.

But, what exactly is this 1120 tax form? Well, it is the tax return that corporations need to file annually to report their income, expenses, deductions, and finally, evaluate the amount they owe in taxes.

These are the details you would need if you had to file IRS Form 1120:

- Your Employer Identification Number (EIN)

- Incorporated date

- Total assets that your company holds

- Total income

- Capital gains

- Tax deductions

- Business tax credits

- Gross receipts

- Cost of Goods Sold (COGS)

- Earned dividends, interest, and royalties

At first glance, it all may look intimidating. But, don’t worry, that’s what this blog post is about. It is meant to solve your question, and give you straightforward answers. So, without further ado, read ahead!

What is Form 1120?

The 1120 form is typically a way for corporations to file their taxes and also comply with the guidelines of the IRS. Unlike individuals, corporations do not actually pay personal rate taxes. Instead, they have always been taxed at the corporate income tax rate.

In case your business is incorporated, you will need to use Form 1120. This form is used to report your earnings, expenses, and also to evaluate your income tax liability.

However, for those corporations that anticipate owing around $500 or over that threshold in taxes for the year use Form 1120-W to report estimated taxes. In simple words, this form assists them to estimate and pay their taxes every quarter. In fact, this is usually a very common practice to manage hefty tax liabilities throughout the year.

Moreover, it is mandatory for all domestic U.S. corporations to file and submit Form 1120, unless, of course, they have an exemption in place. Plus, they need to file the same even if they have zero taxable income or have filed for bankruptcy. Either way, it is necessary for them to do the needful.

Alongside that, foreign businesses typically need to file Form 1120 as well as Form 5472 in the case of any disregarded entities (DE) in the United States. The IRS views these organizations differently from their parent firms.

Having said that, the deadline for Form 1120 is always April 15 of every passing year. One key note here is that if April 15 falls on a weekend, the day is moved to a day ahead, that is, Monday.

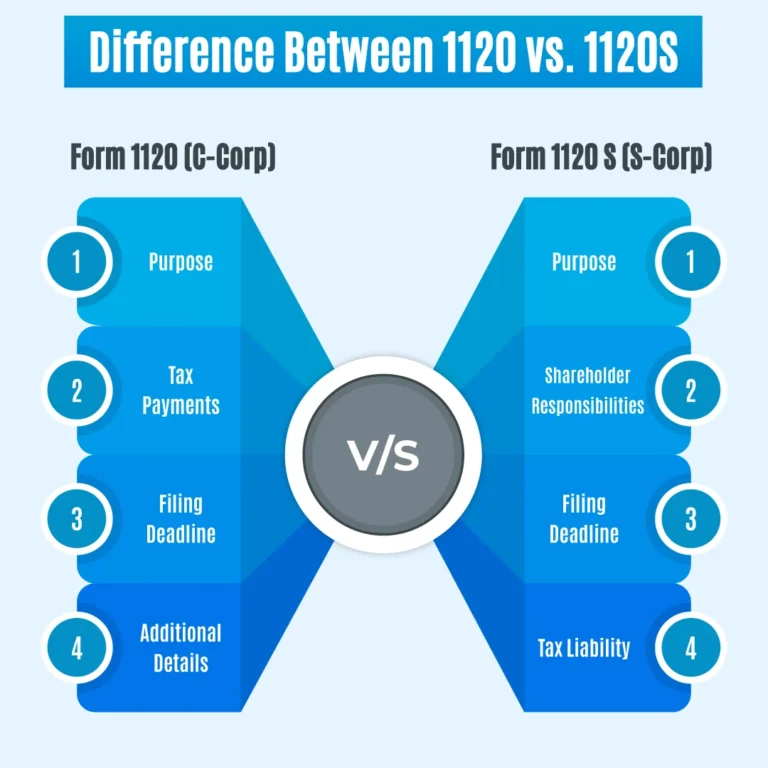

Difference between 1120 and 1120s

When it boils down to corporate taxes, you need to have a clear understanding of Form 1120 and Form 1120-S. That is because, while both sound almost similar, their requirements for the IRS are different. Let’s have a look at how these two forms, while sounding so familiar, differ from one another:

Form 1120: C-Corp

- Purpose: The Form 1120 is primarily used by C-corporations in order to report their annual tax liability.

- Tax payments: The corporation must make all required tax payments directly to the IRS.

- Filing deadline: As seen, Form 1120 is usually to be filed by the 15th day of the fourth month, right after the end of the corporation’s fiscal year.

- Additional details: In case a C corp owes over $500 in taxes, then it must also file estimated tax payments. For those unable to meet the allotted deadline are given a period of extension to prevent penalties.

Form 1120-S: S-Corp

- Purpose: Form 1120-S does not actually evaluate the tax liability directly. In contrast, it is responsible for reporting the income or loss that is distributed to shareholders.

- Shareholder responsibilities: Every shareholder goes to receive a Schedule K-1 from the respective S-Corp. Herein, it outlines their share of income or loss, which further goes on their personal tax returns.

- Tax liability: Well, there is actually zero direct tax liability reported on Form 1120-S itself. Rather, it is on shareholders to report the same on their personal tax calculations.

- Filing deadlines: In general, the due date as per the 1120 S form instructions is the 15th of the third month following the corporation’s fiscal year end.

In simple words, both of these forms help streamline the tax reporting process for corporations but cater to different business structures. This, at large, impacts how tax responsibilities are taken into consideration and fulfilled.

Want to know more about how these two forms are different or need immediate help in filing either?

Get in touch with our in-house specialists.

Who Files Tax Form 1120?

There’s no doubt that every domestic corporation has to file Form 1120. It does not matter whether or not they have taxable income. But, remember that there are corporations exempt under Section 501 who do not need to file this form.

Moreover, corporations that are currently facing bankruptcy proceedings are required to submit Form 1120 as well.

That being said, here’s a list of all the entities that are needed to file Form 1120:

- Businesses that are taxed as corporations: These are the entities that need to file Form 8832 and further attach it to Form 1120.

- Limited Liability Companies (LLC): In case LLCs consider to be taxed as corporations, only then would they be required to file Form 1120. On the flip side, if LLCs function as partnerships, then they must file Form 1065. But, if considering single-member LLCs, then they usually report the said taxes on the owner’s personal tax return.

- Foreign-owned domestic disregarded entities: A domestic disregarded entity (DE) is treated as distinct from its foreign owner if it is owned 100% by a foreign individual or company. All things considered, a DE is basically a business that the IRS does not consider separate from its respective owner. It is true that these two objects actually contradict one another, but it’s just how all of this works in reality. Nonetheless, the foreign corporation or individual is required to file Form 1120 and attach Form 5472.

- Farming corporations: These are the businesses or corporations that use Form 1120 to report their income or loss.

- Corporations with interests in a FASIT: In this case, the Financial Asset Securitization Investment Trust (FASIT) has certain distinct reporting needs.

In addition, certain corporations may need to fill in more documents or schedules, as deemed necessary. This includes Form 1120 (Schedule N) for foreign operations or Form 1120 (Schedule D) in case of capital gains and losses.

When Do I File a 1120 Tax Form?

Form 1120, as also mentioned above, has a due date on the 15th of the fourth month, right after the end of the corporation’s fiscal year. But, in case the fiscal year concludes on the 30th of June, then the form must be filed by the 15th of the third month following the end of the fiscal year.

Well, this deadline similarly applies to corporations with a short tax year that concludes in June. As imagined, they are treated this way because, as per them, the tax year ended right on June 30.

Additionally, Form 7004 is often used in order to request an automatic extension to file Form 1120. For the most part, this extension exists for six whole months. But, this case is a little different for corporations whose fiscal year concludes by June 30 or for those who experience a comparatively shorter tax year. For them, there is a provision for a seven-month extension.

Where Do I File a 1120 Tax Form?

In case you are wondering where to file form 1120, there are different addresses for different perspectives. In fact, there are certain criteria you will have to meet as well, as per the IRS. So, let’s have a look at the requirements for the said address.

| Main Office Location | Asset Total at Conclusion of Tax Year | Address |

|---|---|---|

| Virginia, West Virginia, Wisconsin, New Jersey, Ohio, Pennsylvania, Connecticut, Delaware, District of Columbia, New York, North Carolina, Kentucky, Maine, Georgia, Illinois, Indiana, Maryland, Massachusetts, Michigan, New Hampshire, Rhode Island, South Carolina, Tennessee, Vermont | Less than $10 million and no filing of Schedule M-3 | Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0012 |

| $10 million or more or Schedule M-3 is filed | Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0012 | |

| Arkansas, California, Colorado, Florida, Hawaii, Alabama, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Alaska, Arizona, Idaho, Nevada, Washington, Wyoming, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah | Any amount | Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0012 |

| A foreign country or U.S. possession (or the corporation claims the possessions corporation tax credit under sections 30A and 9936) | Any amount | Internal Revenue Service, PO Box 409101, Ogden, UT 84409 |

What Is Form 1120 Used For?

Form 1120 is actually the official U.S. Corporation Income Tax Return. It is primarily used by C corps and LLCs that choose to be taxed as corporations in order to report their annual financial information to the IRS. In simpler terms, it helps determine how much income tax a corporation owes.

Common Mistakes When Filing Form 1120

Filing this form can often seem challenging and confusing to many. Part of it is definitely scary because even the smallest of errors can lead to bigger delays, penalties, or sometimes, an IRS audit too. That’s why we have curated a list of very common errors that take place when you file Form 1120. Let’s have a look at all of them:

- Missing information: This is actually one of the most common mistakes we have seen to date. Make sure all the important information is filled in accurately and completely, with no mistakes whatsoever. That said, have your corporation’s Employer Identification Number (EIN), income and expense information, along with any other related schedules.

- Math mistakes: This is where you make sure that all financial information, including your income, deductions, taxable income, and tax credits, are perfectly mentioned and have no errors that can later cost you. Not to mention, miscalculations and errors can affect your tax liability. Truth be told, it’s best to use software to reduce the risk of errors.

- Imprecise record-keeping: There’s no doubt that improper documentation in cases of invoices, receipts, and bank statements can result in bigger problems down the line. In fact, it can make it difficult to support the details on Form 1120.

- Missing deadlines: If you want to avoid penalties and interest charges, make sure you file on time and by the due date itself. This is where you can consider filing electronically for better and faster processing.

- Misclassifying income or expenses: Always make sure you accurately categorize the income and expenses on the exact lines of the form. Often, misclassifications are exactly what lead to mistakes in tax calculations.

There are several other errors that people make over time on this form. In that light, make sure you avoid these very common mistakes to prevent the looming pitfall.

Bottom Line and Key Takeaways

So, there you have it. As you know, there are a lot of things businesses have to deal with. Starting from Accounts Payable (AP) to understanding their operating expenses, businesses have a lot to deal with over the course of time.

In between this constant tussle with so many items lined up one after another, business owners often lose out on a handful of things to look out for. One of them is properly filing for Form 1120.

It’s important to stay on the right side of the bed with the IRS. Because, if you are not, there can be problems that will be too late to fix. Plus, make sure you are meeting the required deadlines on time, and if not, don’t forget to let the IRS know. Chances are they will consider your unfavorable circumstances if you make them aware right away.

For more details, have a brief glimpse at Form 1120 PDF and read the instructions thoroughly before proceeding forward.

Have trouble understanding the information on the Form 1120 instructions? Our in-house experts at The Ledger Labs can help you in no time. With 12+ years of experience, there’s no challenge that they have not seen by now. Let them do the deed for you so that you can focus on more important parts of your business. Get in touch today!