When you run a business, there’s always a decision to make – whether big or small. In all the decisions you make in a day, some of them are about “spending” in a business. But, here’s the thing, not all expenses are created equal. What we mean to say is that “expenses,” as a word itself, has different classifications – just like any other financial word or phrase. Sounds a little too baffling, right?

In simple words, a business can classify its costs either as capital expenditures or revenue expenditures. Now, as a result, this classification is further going to have an effect on the financial statements, taxes, and profits. In fact, not many would even know what the two terms, under different lights, would mean.

But, the basic difference between the two phrases finally boils down to this: Capital expenditures are those investments made in long-term assets that are going to yield returns for the business over an extended period of time. On the flip side, revenue expenditures are the continuous costs of day-to-day operations.

As many would ask, why are they even important? What’s there in it for us? What do they mean, at large?

Well, this distinction is highly imperative to understand, regardless of your business type or industry. For the most part, it helps you do accurate bookkeeping, make wise business decisions, and comply with the changing accounting laws.

But, the more you try to understand the differences, the more questions surface. So, here is a guide for you – simple, straightforward, and comprehensive. This blog post will help you learn what both terms mean, their formula, and how they are different from one another. So, let’s get started!

What is Capital Expenditure?

Capital expenditure, also often called “CAPEX” or “CapEx”, is basically the funds a business uses to buy, upgrade, and also uphold physical assets, including but not limited to equipment, property, or certain intangible assets, such as trademarks and patents.

But, the question is, what is it normally used for? In layman’s terms, CapEx is generally used by a company to undertake fresh investments and projects. In fact, it is a long-term investment a company makes to expand its operations, improve efficiency, or take on new initiatives (like a project, as mentioned right above).

In addition, capital expenditures are usually claimed for fixed assets that have a useful life of over a year. These are the same assets that are further capitalized on the company’s balance sheet and are not entirely expensed during their purchase period.

If you did not know, capital expenditures are represented on a company’s balance sheet since they exhibit long-term investments in assets that will offer numerous advantages over several accounting periods.

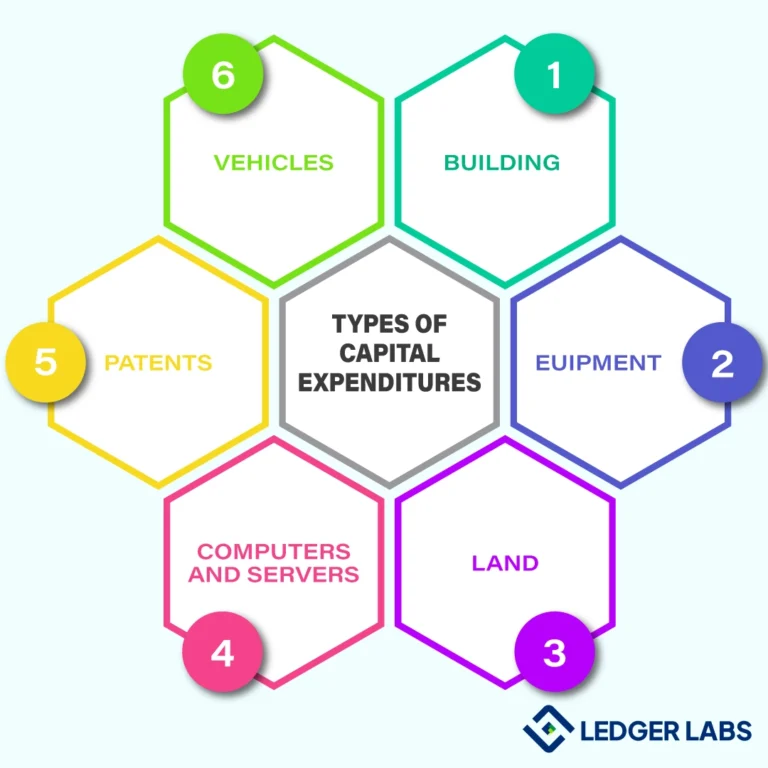

Types of Capital Expenditures

Now that the concept is rather clear to you, the next in line is to understand the types it houses. So, here’s a detailed breakdown of the types:

- Buildings are one of the top of the list since they are used for manufacturing goods, are considered office spaces, and also often used as a storage space for inventory.

- Equipment, in a business, is majorly used to produce goods and turn raw materials into final products.

- Land is also an important type, in this case, used primarily for further development.

- Computers and servers are one of the biggest additions to this list, as they support a business’s operational areas, such as its reporting and logistics – among others.

- Patents are equally a part of this list, as you are holding a long-term valuable asset that can be indispensable in the long run.

- Vehicles can also be considered in this list as they help businesses transport goods or are used by staff members for various other reasons.

Have questions regarding capital expenditure vs. revenue expenditure:

Consult our expert accountants!

Formula of Capital Expenditure

The capital expenditure formula is as follows: CapEx = ΔPP&E + Current Depreciation

Herein,

- CapEx = Capital expenditures

- ΔPP&E = A change in property, plant, and equipment

What is Revenue Expenditure?

It always takes money in order to make money. Let’s say you run a small retail store in Arizona. Each month, to keep the place yours, you pay rent for the store. Along with it, you also pay out salaries and wages to the respective workers in your business. Plus, there is also another major payment – your electricity bills – to keep the store’s light on. Whatever you just read are mere examples of revenue expenditures.

In simple words, revenue expenditure is the cost a company bears to sustain its day-to-day operations and earn revenue during an allotted time frame. The important thing to remember, in this case, is that this kind of investment does not produce any long-term assets or benefits for your business that stay past the current phase. You just incur these expenses, over time, every month, to keep operations in your business up and running during a certain period.

Any business, regardless of size, must pay some amount of revenue expenditures every day, every week, or every month in order to cover operating expenses. These types of expenditures are usually repetitive in nature and have a shorter term period.

Types of Revenue Expenditures

Here are the types of revenue expenditures you should be aware of:

Direct expenses

Direct expenses, as the name indicates, are those expenses that are incurred with the manufacturing or delivery of products or services. When considering the manufacturing setting, these primarily include the expenses associated with turning raw materials into final products. In simple terms, this can be anything between the material cost, production labor, along with any other expense related to the manufacturing process. Furthermore, when we talk about direct expenses, it circles around the costs associated with normal, daily business operations. As we mentioned earlier, it can involve electricity used in manufacturing, related legal fees, and rent – among others.

Indirect Expenses

On the other side, there are indirect expenses. Indirect expenses are expenses that are not directly associated with the delivery or manufacturing of products or services. However, they are highly imperative for the total support and functioning of the business. Every concept is best understood with an example. In this case, indirect expenses can be anything, including but not limited to taxes, asset depreciation, and interest payment – among others. The costs associated with facility, equipment repair, and maintenance are also assessed as indirect expenses. Why, you may ask? That is because they help assets run efficiently, which in turn makes the business operate well.

How to calculate revenue expenditure?

As you may know already, the expenses that are charged against revenues gained during an accounting period are referred to as revenue expenditures. They are the regular or repetitive costs that are incurred in order to produce income. Now, if you have to know the revenue expenditure formula for further calculation, then, in words, it can be defined as:

“Revenue expenditures are evaluated during the ongoing accounting period. In this case, the first step is to track all the direct and indirect costs of the current operations. After these expenses are accounted for, they can be further added together to calculate the total revenue expenditure for the respective accounting period.”

How are Capital and Revenue Expenses Accounted for in Financial Records?

When you closely look at a financial statement, you can see that capital expenditures and revenue expenditures are recognized in different sections. It showcases its different characteristics and accounting treatments. Let’s now look at how both of these terms are included in a company’s financial statements:

Capital Expenditure

Look at the balance sheet and go over the “asset” section. The reason why capital expenditures can be found under “assets”on the balance sheet is because it encompasses acquiring or upgrading long-term assets to expand the value of the business. Just so you know, these expenses depreciate over time, during their approximate useful life.

Revenue Expenditure

Look at the “expense” section of the income statement. What you immediately see is revenue expenditures, since they typically appear as expenses. In general, these are deducted from the revenue during the time period they take place. As you can probably guess, revenue expenditures do not impact the balance sheet in the same long-term manner as seen in capital expenditures. On the contrary, they are recorded as “immediate expenses” that occur over a specific timeframe. They are recurring in form and contribute to the running of your business, directly or indirectly.

That’s about it. But, since both of these terms are still a form of expense, you will probably be a little confused by their immediate differences. So, now that you know where they are located, let’s have a look at how they differ from one another – and make things clearer for you.

To Understand Revenue Recognition click here!

Difference between Capital Expenditure vs Revenue Expenditure

Well, it is rather safe to say that capital expenditure is actually everything that its opponent, revenue expenditure, is not. While they stem from the same surname, “expenditure,” they are surprisingly nothing alike. Their differences are apparent and can be defined pretty well. So, let’s have a look at how these two terms (Capital Expenditure vs Revenue Expenditure), while sharing the same roots, are different from one another.

- Nature of expenses: As said earlier, capital expenditure is more inclined towards the acquisition and upgrading of long-term assets to fortify growth and maximize expansion. On the other hand, revenue expenditure is closely related to the daily, recurrent expenses of running a business.

- Time period: While capital expenditures are long-term in nature and span over several accounting periods, revenue expenditures are bound to a certain, limited accounting period.

- Benefit period: Capital expenditures keep generating benefits over a prolonged period of time, given the specific useful life of the asset. As opposed to that, revenue expenditures generate benefits during the same accounting period in which they have been incurred. This goes to show their short-term nature, unlike the former.

- Accounting treatment: Capital expenditures, as said, capitalize on the company’s balance sheet. Moreover, they are steadily expensed via amortization or depreciation throughout their useful life. Revenue expenditures, on the contrary, are recognized and recorded as “expenses”, that go to minimize the business’s net profit for a certain period.

- Effect on financial statements: Capital expenditures impact the balance sheet, along with the cash flow statement, of a business. It basically influences the values of assets and has an effect on the calculations associated with amortization and depreciation. On the flip side, if you look at revenue expenses, they directly impact the income statement since they are subtracted as expenses.

Capital Expenditure and Revenue Expenditure Examples

The best way to even understand a concept well is by looking straight at an example. That being said, read ahead to understand what both capital expenditure examples and revenue expenditure examples mean.

Capital Expenditure Example

Let’s consider an industrial firm that just recently upgraded its equipment and facility infrastructure. In the beginning, the overall value of its property, plant, and equipment (i.e., PP&E) was set at $150,000. However, it gradually experienced major upgrades. Soon after upgrades, the updated value of the PP&E rose to $180,000. Apart from that, the business also recorded a current depreciation expense of $6,000.

Now that we have every little detail, let’s input the formula of CapEx. Therefore, the capital expenditures formula is:

CapEx = Change in PP&E + Current Depreciation

Hence, replacing the words with the necessary values, we get:

→ ($180,000 – $150,000) + $6,000

→ $30,000 + $6,000

Thus, the CapEx can be considered as = $36,000

Therefore, the capital expenditures for the upgrades are $36,000.

Revenue Expenditure Examples

Let’s consider a company named Axeno. They have been spending $1,200 every single month on updating a very integral software used by employees at each desk. This figure – $1,200 – can be considered as the revenue expenditure in the financial statement of Axeno during that month alone.

Similarly, consider that there is another small business called Realtea. Assuming that they have been incurring around $500 on a monthly basis for supplies needed for production, the figure is recorded as a revenue expenditure, too, for that specific period.

Additionally, the total yearly costs for the listed items ($1,200 x 12 = $14,400 for the software and $500 x 12 = $6,000 for supplies) can be entirely subtracted from both business’s taxable income during the year their expenses are paid for.

Closing Thoughts and Key Takeaways

Money out the door is not just money out the door. What we mean is that businesses spend their money in different ways, which even makes their expenses vary from one another.

Truth be told, capital expenditures and revenue expenditures are entirely different from each other but still stem from the roots of expenses itself. So, getting this distinction correct is vital for you, since it goes to impact everything in between. From how you are reporting your finances to how you allocate resources and evaluate taxes – these terms are everywhere you look at. In case you somehow misclassify these expenses, there can be serious mistakes that can cost you significant money.

Plus, as you may know, you cannot build a business if you are not spending some cash. But, the catch is, not all spending is created equal. While one focuses on long-term, big investments treated as assets, the other deals entirely with day-to-day operating costs that help keep your business running on track.

While not the same, they are both equally as important to keep your business afloat, running, and thriving – for the years to come.

Still have unanswered questions? You know who to talk to. Get in touch with the accounting experts of The Ledger Labs, who have more than 12 years experience in the field and get all your answers under one roof. So, what are you waiting for? Give us a call or book a consultation now.