In the business world, the two terms you’ll hear more often than not are accumulated depreciation and depreciation expense. While they almost share the same name, there is a hint of difference between the terms. Be that as it may, they are both key indicators of a business’s asset management. Without further ado, let’s get to the bottom of both these terms so that you understand better.

Accumulated depreciation is the figure that shows the total value of your assets on the basis of their useful life (and more). On the flip side, depreciation expense is basically an accounting term that indicates the gradual value reduction of a fixed asset over a period of time. But, why are they important? How do we determine them on financial statements? Well, we have covered it all for you. Read along to learn more!

Importance of Understanding Depreciation in Accounting

Understanding depreciation in accounting is important for more than one reason. We have outlined these reasons as below:

- Asset value management: Depreciation helps you understand the value of assets over a timeline. In other words, when a company purchases an asset, it doesn’t suddenly lose value. Instead, its value gradually decreases over time. In this way, every business can hunt down this steady decrease in value, making sure their financial statements represent the true worth of the assets they own.

- Investment decisions: This holds true for several investors. They usually look at a company’s depreciation methods to analyze its financial wellbeing.

- Tax benefits: Depreciation, if you didn’t know, is a vital factor in tax calculations. For example, businesses can typically deduct depreciation related expenses from their taxable income. As a result, it leads to substantial tax savings.

- Performance measurement: Depreciation is known to impact several financial metrics, including EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). These are the same metrics necessary to determine a company’s profitability and performance.

Definition of Accumulated Depreciation

Accumulated depreciation, in simple words, is an accounting term that indicates the total depreciation expense amount which is recorded against a fixed asset. When defined in another way, it simply reflects an asset’s value that has been used up over a time period.

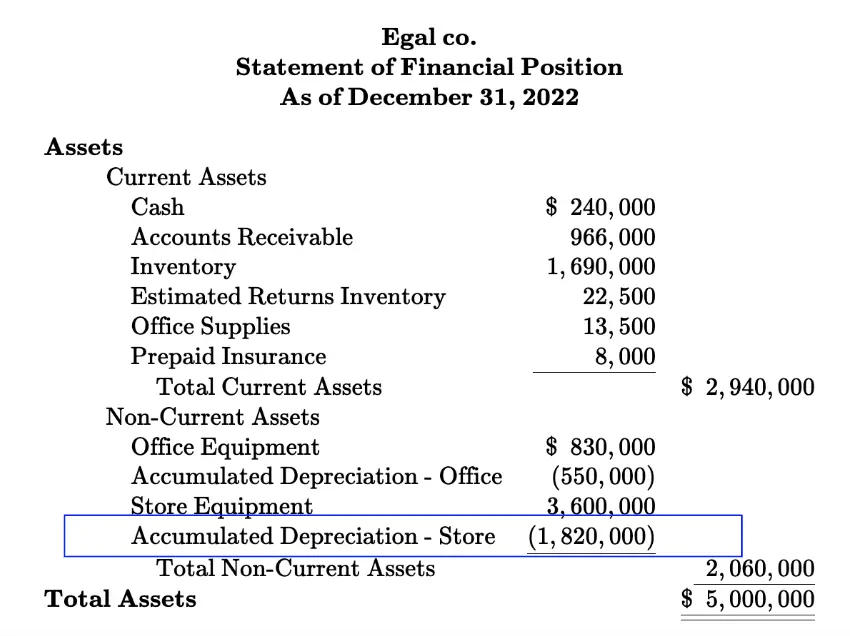

You can usually find accumulated depreciation on the balance sheet. On a balance sheet, you can see it reduce the value of the related asset.

How Accumulated Depreciation is Calculated and Recorded?

The amount of depreciation which is recorded every accounting period, i.e. monthly or annually, depends basically on the method of depreciation used. Some of the standard methods usually include declining balance, straight-line depreciation, double-declining balance method, sum of the year’s digital method, and units of production.

When digging through each common depreciation method, this is what we can find:

1. Straight-Line Method:

This is actually the simplest of all the methods. In fact, it is the most commonly used method in many instances.

The formula of the Straight-line method is:

Annual Accumulated Depreciation = (Asset Value – Salvage Value) ÷ Useful Life in Years The straight-line method is known to spread the cost of an asset evenly over its useful life. That is to say, it is typically evaluated by subtracting the salvage value from the purchase price. After that, divide the total by the anticipated number of years of use.

Example:

Let’s say a company purchases a computer system for a price of $8,000, expecting it to last around 5 consecutive years with a salvage value of $1,000.

When calculated, the annual depreciation can be recorded as: ($8,000 – $1,000)/ 5 years = $1,400 per year. Therefore, the company records $1,400 in depreciation expense every year.

2. Declining Balance Method

In this case, the depreciation is actually a fixed percentage of the current book value of the asset. As a result, we can observe a decreasing depreciation amount every year.

The formula of declining balance method is

Annual Accumulated Depreciation = Current Book Value x Depreciation Rate Example:

Let’s say a company buys machinery for a value of $15,000, anticipating its depreciation by 25% annually. During the initial year, it records $3,750 = 15,000 x 25% in depreciation. In the following year, it depreciates to $2,812.50 = [($15,000 – $3,750) x 25%]

3. Double Declining Balance Method

In this method, we usually double the straight-line depreciation rate, leading to accelerated depreciation in the initial years. Hence, the percentage can be easily calculated by dividing the number of years of useful life by twice the percentage of 100%. Here is how it is calculated through the formulas:

Double-Declining Balance Method Rate = (100% ÷ Useful Life in Years) x 2

Double-Declining Balance Method = Depreciable Amount x Double-Declining Balance Method Rate Example:

Assume a business spends $50,000 on equipment that has $5,000 in salvage value after ten years. In this case, you can observe that the straight-line rate is 10% (100% ÷ 10 years). Hence, the double-declining rate is 20%. Depreciation is $9,000 (45,000 x 20%) in the initial year of operation. In the following year, the depreciation is recorded as $7,200 (($45,000 – $9,000) x 20%).

4. Sum-of-the-Years’ Digits Method

This method allocates more depreciation in the early years of an asset’s life, using the sum of the years’ digits for calculation.

The formula for Sum-of-the-Years’ Digits Method:

Annual Accumulated Depreciation = Depreciable Base x (Inverse Year Number ÷ Sum of Year Digits) Example:

Let us take an example where a company purchases equipment with a $20,000 depreciable base and a 4-year life. In this case, we can see that the sum of years’ digits indicates 10 (4+3+2+1). In the first year, it depreciates $8,000 [that is, ($20,000 x (4/10)]. While in the year next, it shows $6,000 [$20,000 x (3/10)].

Want help with accumulated depreciation calculation?

Get instant answers from our expert accountants!

5. Units of Production Method

In this case, a company first tries to understand the total number of units an asset can yield over its entire lifetime. By comparing the quantity produced to the total expected production, it determines the amount of the asset depleted yearly. Therefore, the depreciation recorded for that specific year depends on this usage.

The formula for the “Units of Production” is:

Annual Accumulated Depreciation = (Number of Units Consumed ÷ Total Units to Be Consumed) x Depreciable Base Example:

For instance, let’s consider that a company buys a printer that came with a lifespan of 100,000 prints for $5,000. Given that it produces an approximate 10,000 prints in the initial year, $500 (10,000 ÷ 100,000 x $5,000) can be recognized as depreciation. With 15,000 prints the following year, it records a depreciation of $750, which totals up to $1,250 ($500 + $750).

Related Articles:

- How Much Does Online Bookkeeping Charge? A State-wise Price List

- Learn Reading A Balance Sheet With Examples

- Should You Hire a Controller or a CFO and Why?

- What is Cash Reconciliation and its Benefits for a Business?

- What is Balance Sheet Reconciliation and Its Importance in a Business?

- Exploring Income Statement and Balance Sheet in Detail

How Accumulated Depreciation is Used in Financial Statements?

To get a better picture, let’s look at a detailed example.

Example:

Let’s assume that a company bought a van for a price of $50,000, expecting to use it for 5 consecutive years with a salvage value of $5,000. Considering that the uses a straight-line method for depreciation, we can calculate:

= (Cost of Van – Salvage Value) / Useful Life = ($50,000 – $5,000) / 5 Years = $9,000 per year

The financial statement recorded in the first year:

- Depreciation Expense: The income statement books a depreciation expense of $9,000 during the initial year.

- Accumulated Depreciation: Furthermore, the $9,000 is then added to the accumulated depreciation account. This is actually the contra-asset account on the balance sheet.

- Net Book Value: Now, if you look at the balance sheet closely, the van was recorded in the first year for $50,000. In the year next, its book value seems to have adjusted to $41,000 ($50,000 cost – $9,000 accumulated depreciation)

Over the next few years, an extra $9,000 will be added to the accumulated depreciation account. After 5 years pass by, the total accumulated depreciation will reach the value of $45,000. As a result, it will bring the van’s book value down to its salvage value of $5,000.

Definition of Depreciation Expense

Depreciation expense indicates the amount of depreciation recorded on a company’s balance sheet for a single period of accounting. It is typically known to be a non-cash expense since the recurring monthly depreciation entry doesn’t comprise a cash transaction. Furthermore, the regular depreciation expense is actually debited from the income statement.

Calculation of Depreciation Expense

1. Learn the Cost of the Asset: This can be anything between the purchase price and other extra costs essential to bringing the asset to a usable state.

2. Identify the Salvage Value: Now, it’s time to understand the asset’s value by the end of its useful life. In other words, this is basically the amount you wish to recover after using the asset for its useful life.

3. Determine the Useful Life: In simple words, this is an estimate of how long you anticipate the asset to be useful for your company. It can be measured through months, years, or units of production, totally based on the depreciation method employed. Some common methods, as also defined above, are:

- a) Straight-Line Method: This is known as the simplest approach and helps to record the same amount of expenses yearly.

b) Declining Balance Method: This is usually a quicker depreciation method that helps to record larger expenses during the initial years of the asset.

c) Units of Production Method: This method is typically bound to the asset’s usage or production.

4. Calculate the Depreciation Expense: Now, based on the chosen method, you need to implement the formula to evaluate the annual depreciation expense.

Recording of Depreciation Expense

1. Usually, a journal entry is made every accounting period (i.e., monthly or annually) to record the depreciation expense. It broadly involves:

- a) Debiting the Depreciation Expense account

- b) Accumulated Depreciation account.

2. Under Generally Accepted Accounting Principles (GAAP), the annual depreciation expenses must be represented in a contra asset account of the balance sheet.

Want help with depreciation calculation?

Get instant answers from our expert accountants!

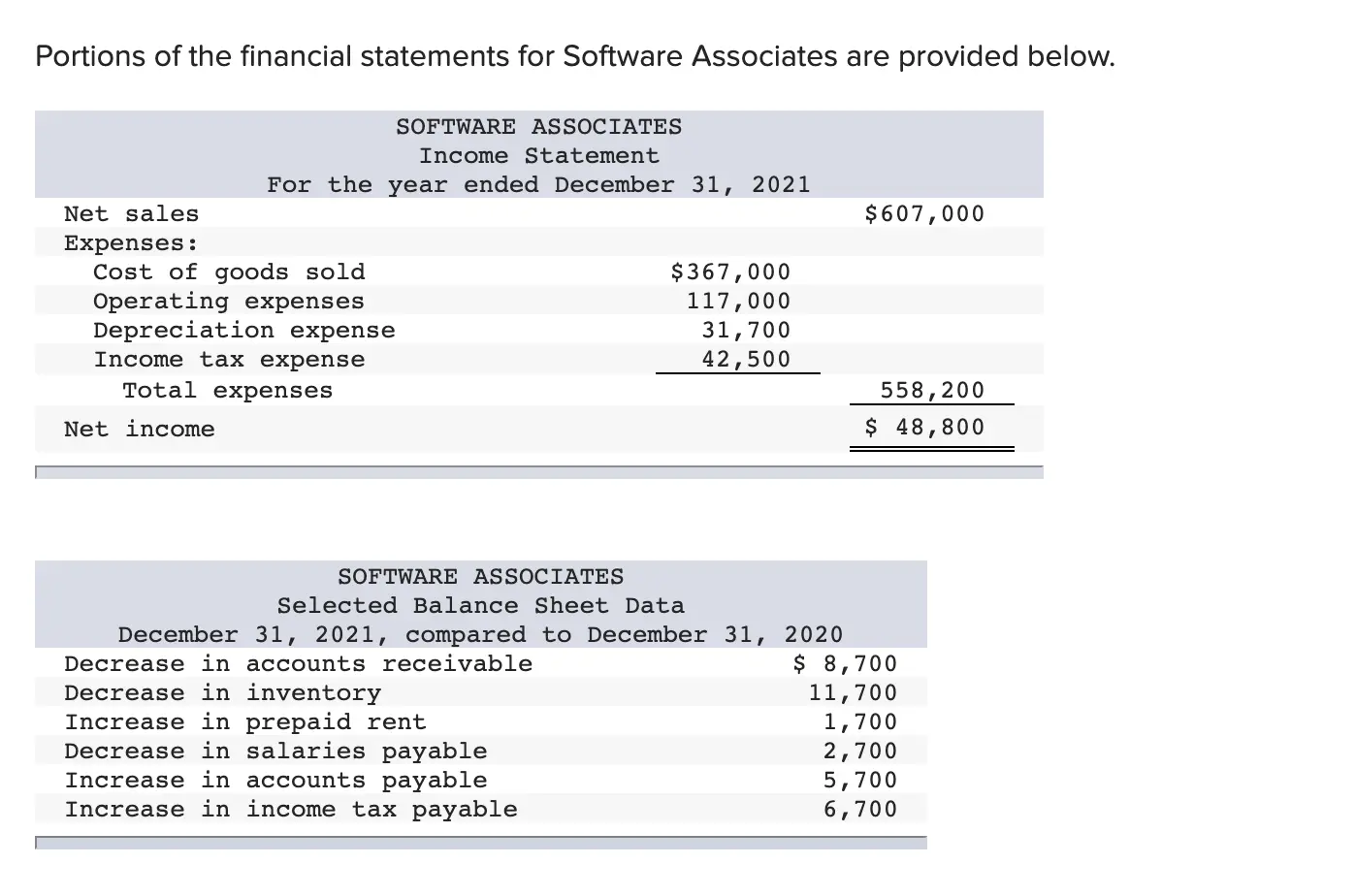

How is Depreciation Expense Reported in the Financial Statements?

This is how depreciation expense is reported on financial statements:

- For the Income Statement: The depreciation expense is indicated under operating expenses for a given period.

- For the Balance Sheet: The asset’s net book value falls as accumulated depreciation rises. However, note that its historical cost remains the same.

Difference between Accumulated Depreciation and Depreciation Expense

In order for you to understand accumulated depreciation vs. depreciation expense better, we created a comprehensive difference table that explains both sides more clearly:

| Accumulated Depreciation |

|---|

| 1. This is basically the cumulative depreciation expense that’s been recorded for an asset since it was used for the first time. |

| 2. Recorded as a credit, this can minimize the balance sheet's gross fixed asset amount. |

| 3. This usually adapts to the asset’s book value for reasons like tax purposes. Therefore, it impacts gain or loss on sales. |

| 4. In this case, the accumulated total is subtracted during the asset’s disposal or retirement. |

| Depreciation Expense |

|---|

| 1. It's the depreciation expense/cost allocated to an asset during a certain accounting period (i.e. annually or yearly). |

| 2. Recorded as a debit, this is basically listed on the income statement (typically wherein it minimizes the earnings). |

| 3. By gradually realizing the cost of assets, it helps to decrease the taxable income. |

| 4. The asset's retirement from use or just a simple disposal marks the end of depreciation. |

Click here to watch a video – Accumulated Depreciation and Depreciation Expense: All You Need to Know!

In wrapping up

Correctly accounting for depreciation is really important to get a fair view of a company’s financial well-being.

Quite frankly, this precision helps us to realistically see an asset’s value reduction over time, guaranteeing that unaccounted asset expenses don’t really inflate earnings.

To be more precise, accumulated depreciation and depreciation expense help us observe how a business uses and values its resources. More importantly, this is vital information for everyone involved, from the investor to the business manager.

Need more information? Get direct answers from accounting experts with more than 12 years of experience!

Related Articles:

- 12 Benefits of Online Bookkeeping Services For Your Business

- What Does a Bookkeeper Do?

- Single-Entry or Double-Entry Bookkeeping: Which One Should You Choose?

- Unveiling the Secrets of Small Business Profit and Loss Statement

- All about Net Income and Gross Income: Formula, Templates, Tips and more

- What is Cash Burn Rate and How to Calculate it?

Frequently Asked Questions

1. Is depreciation expense a temporary account?

Yes. Depreciation expense is mainly considered as a temporary account. In simple words, its balance begins at zero every accounting period, and is then closed to an equity account (typically, retained earnings) at the period’s end.

2. Is depreciation expense a liability or asset?

To be precise, depreciation expense in itself isn’t a liability or an asset. It is basically an expense that is identified on an income statement.

3. Is depreciation a deferred expense?

No, depreciation is actually not a deferred expense. Put differently, an expense that has been paid for now but will be incurred later is known as a deferred expense. In contrast, depreciation is an expense that indicates the gradual reduction of the value of an asset over its useful life.

4. Is depreciation expense credit or debit?

To be precise, depreciation expense is “debited”. In layman’s language, it increases the expense section on an income statement, while decreasing the retained earnings.

5. What is a journal entry for depreciation expense?

Typically, the journal entry for depreciation expense is about crediting accumulated depreciation (a contra-asset account that helps to keep track of the total amount of depreciation taken on an asset) while debiting depreciation expense.

6. Is depreciation a non-cash expense?

Yes, depreciation is actually a non-cash expense. Put another way, it implies that while there is a decrease in net income on the income statement, there is no actual cash outflow from the business.