Who doesn’t want quick, effortless budget creation and forecasting? Frankly, spreadsheets can be a good choice, but let’s not forget that it’s often inefficient, prone to errors, and doesn’t help to work together. NetSuite Planning and Budgeting is what helps you do that.

In other words, it helps streamline your financial procedures, transitioning how your finance team works. Plus, you can access all features in just one collaborative and scalable platform.

NetSuite Planning and Budgeting takes extra care to automate manual consolidation, data loading, and troubleshooting so that your staff can focus on more than data entry. But, what makes it so important, and why should businesses know about it?

This article answers that question for you. It is your one-stop destination for all questions, including tips for planning and budgeting. With NetSuite, the possibilities are many. So, explore them in no time!

Key Features of NetSuite Planning and Budgeting

1. Scenario Planning and Modeling: You can now create complex models with numerous dimensions, such as location, customer, product, or expense. This is where you can accurately forecast revenue, expenses, headcount costs, and cash flow, among other vital metrics, without the uncertainty about formula errors that come with constant updates.

2. Budgeting and Forecasting: It’s time to make budgeting easier and faster for your company. With pre-built workflows on the basis of best practices, you can simply keep an eye on steps like reviews and approvals. In simple words, the budget templates start filling in automatically, and update with data from NetSuite’s general ledger, regardless of the changes in accounting segments.

3. Revenue Planning: Considering different factors, streamline the procedure of future revenue projection. With revenue planning it becomes very easy to align revenue forecasts and sales plans with the objective of corporate. Plus, you can build revenue and sales forecasts for different business units with sales, finance, and service teams. It becomes far more accessible to track the resulting impact on balance sheets and cash flows.

4. Operational Expense: You can now closely monitor all operational expenses. With NetSuite Planning and Budgeting, you can easily link your operating assumptions to financial results. A hierarchical planning process revolves around corporate finances and several business units.

5. Workforce Planning: You can optimize workforce planning, alongside other efforts, like headcount, salary, and compensation planning, by aligning organizational priorities to add momentum to your goals.

6. Trended Financial Statements: The fully integrated financial statements make sure that income statements, cash flow statements, and balance sheets are perfectly in line with Generally Accepted Accounting Principles (GAAP).

7. Data Synchronization: NetSuite ERP offers pre-built data synchronization that helps in accessibility and data accuracy. In simple terms, this guarantees that your plans, forecasts and budgets constantly have updated financial and operational data, alongside dimensions and account structures.

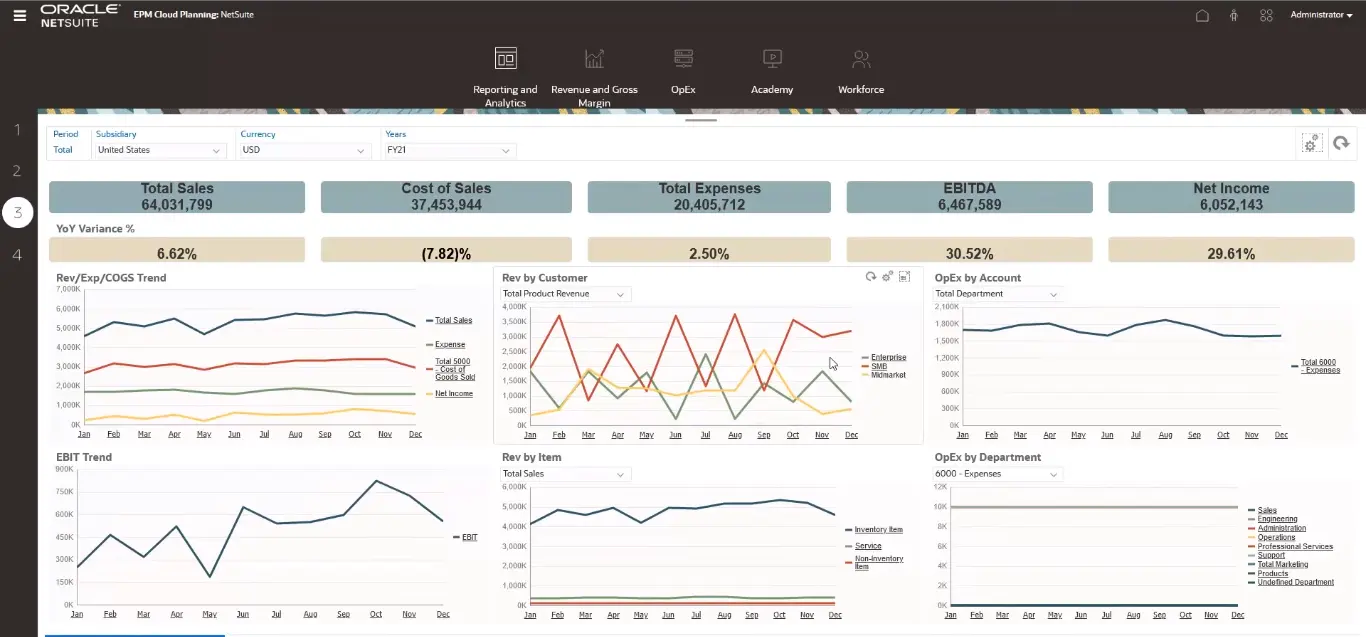

8. Dashboards: This feature gives you a full display of budget and actual data in just a few minutes. The best part is that finance and business managers can now easily create complex web-based reports with NetSuite’s creative drag-and-drop report builder. Plus, this secure and collaborative system makes the method of defining, authoring, reviewing and publishing financial and management reports completely seamless.

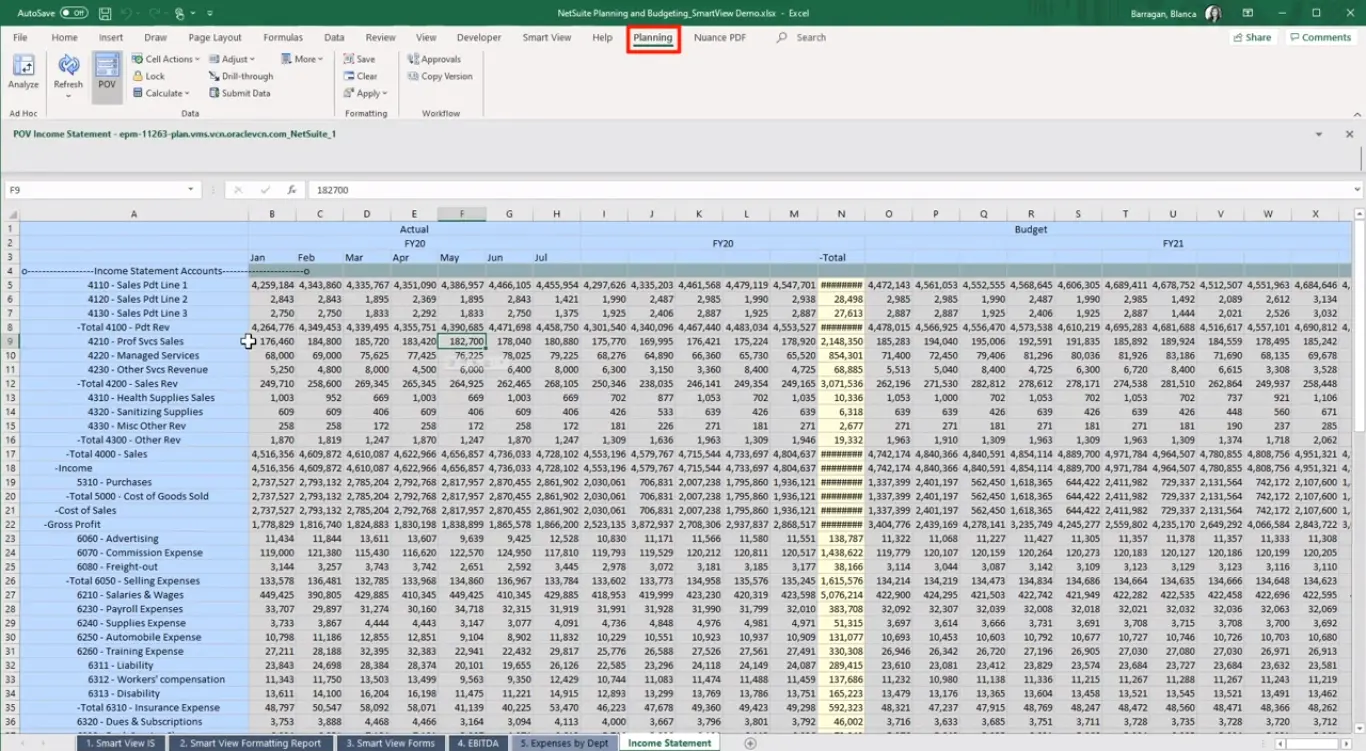

9. Microsoft Office Integration: Smart View for Office now integrated NetSuite Planning and Budgeting MS Office applications like PowerPoint, Excel, Outlook and Word. Using this integration, users can conduct “what-if” analysis on Excel (heavily concentrating on customers, expenses or products). On top of that, you can now manage planning tasks like allocation and data spreading in Excel itself. That makes it 2X better in nature.

10. Predictive Planning: Intelligent Performance Management uses AI to boost decision-making. That’s not it. It also automatically monitors and analyzes data from plans, forecasts, and differences to further spot unusual patterns, and trends.

Challenges Solved by NetSuite Planning and Budgeting

90% of NetSuite Planning and Budgeting users have surveyed and mentioned achieving “increased visibility.” In addition, they now have better control over business operations, with organizational alignment.

This is clearly how it targets small business budgeting and planning issues and solves them. Here are challenges that NetSuite Planning and Budgeting addresses:

1. Manual Processes: With pre-built integrations, you can avoid costly errors caused by manual data transfers.

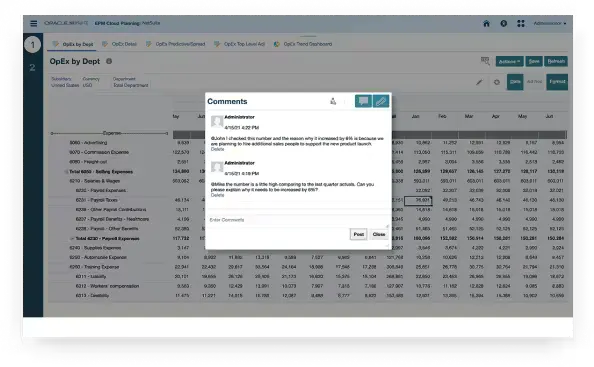

2. Lack of Collaboration: For collaborative planning, budgeting and forecasting, users can now share comments and assumptions.

The picture above is a dashboard view with collaboration facility on NetSuite Planning and Budgeting. Notice how team members can highlight and communicate areas of concern ensuring speedy redressal.

3. Uinformed Decisions

Get a detailed comparison of budget-to-actuals for gaining invaluable insights and making sound decisions.

5 Tips for NetSuite Planning and Budgeting

While implementing and using NetSuite Planning and Budgeting, keep the following tips in mind.

1. Assess Planning and Budgeting Needs

This is a time taking, but nevertheless, crucial task. Begin by analyzing your company’s goals and objectives. What are your long-term and short-term targets? This will provide insight into what financial resources, strategic planning, and budgeting are required to achieve those goals. Next, evaluate the current financial health of your business. Look at your previous financial statements, cash flow, and profitability.

This will help identify areas that need improvement and determine the budgeting requirements for each department or project. Additionally, consider the competitive landscape and market conditions. Are there any emerging trends or potential threats that you need to plan and budget for?

Lastly, involve stakeholders such as key employees, investors, and advisors in the evaluation process. Their perspectives and expertise can provide valuable input and ensure that your planning and budgeting requirements align with the overall business strategy.

2. Use Templates and Workflows

Using the pre-built workflows and templates of NetSuite can be incredibly advantageous for businesses. These pre-built workflows are designed to streamline and automate various processes, including budgeting, and can save a significant amount of time and effort.

Further, by implementing these workflows, businesses can minimize errors that may occur during budgeting, as the workflows are built with best practices in mind. This means that businesses can rely on these pre-built workflows to ensure accuracy and efficiency in their budgeting processes. Overall, utilizing NetSuite’s pre-built workflows can greatly benefit businesses by saving time and reducing the likelihood of errors, ultimately leading to improved budgeting practices.

3. Make sure to Integrate Systems

NetSuite’s integration capabilities allow for seamless connections between different aspects of a business, such as finance, supply chain, and customer relationship management. By integrating these various functions, businesses can ensure that accurate and up-to-date data is shared across different departments, eliminating the need for manual data entry and reducing the risk of errors.

Additionally, NetSuite’s integration abilities enable businesses to automate and streamline processes, improving efficiency and productivity. For example, orders can be automatically processed and tracked, inventory levels can be seamlessly updated, and customer information can be easily accessed and managed. Overall, by fully utilizing NetSuite’s integration abilities, businesses can achieve higher levels of data accuracy, operational efficiency, and overall success. Read more about NetSuite integrations here.

4. Use Predictive Planning

With NetSuite’s predictive planning ability, businesses can gain valuable insights into their future financial circumstances. This tool allows companies to forecast potential challenges and opportunities, enabling them to make informed decisions and take appropriate actions in advance.

By analyzing historical data and using advanced algorithms, NetSuite’s predictive planning can provide accurate predictions and recommendations for budgeting, cash flow management, and resource allocation.

This proactive approach allows businesses to better prepare for any financial uncertainties, mitigate risks, and maximize opportunities, ultimately leading to improved financial stability and success.

5. Train Your Team

Are you confident that your team has been trained on all the features of NetSuite? NetSuite planning and budgeting training is essential for organizations that want to effectively manage their financial resources and achieve their strategic goals. The training helps employees understand how to use NetSuite’s planning and budgeting tools to create accurate forecasts, identify potential risks and opportunities, allocate resources effectively, and monitor performance against financial targets.

This training provides individuals with the knowledge and skills needed to optimize financial planning processes, contribute to informed decision-making, and ultimately drive business success.

Need help with NetSuite Planning and Budgeting implementation?

Connect with our NetSuite experts now

NetSuite Planning and Budgeting Benefits

The benefits of this tool have been summarized below.

- Get more control than ever: NetSuite Planning and Budgeting gives organizations better control and grip over their financial planning. With better connections and more real-time information, it becomes easier to see past the line and know how your finances are doing.

- Improved organizational alignment: Centralizing planning and budgeting helps to unite all stakeholders, minimizing the demand for sharing data through emails or spreadsheets.

- Saves you time: Cut down on your planning cycle by 50% with NetSuite Planning and Budgeting’s pre-built workflows and templates. What’s more, you can now reduce your budget cycle by up to 71% as opposed to spreadsheets.

- Better Forecasts: You can now easily compare your forecast to the actual results, fine-tuning models for better accuracy over time.

- Stronger Data: The best thing about NetSuite Planning and Budgeting is that it perfectly syncs with NetSuite ERP. Moreover, this ensures greater accuracy with budget and reports populated with real-time data.

Case Study: How apparel brand Marine Layer enhanced their demand planning using NetSuite Planning and Budgeting

Marine Layer, an apparel brand popular for its soft T-shirts, has seen substantial growth since its inception in 2009. Consequently, the organization expanded to more than 40 stores across the country. But, the growth came with a shockwave. It brought challenges in inventory management and planning.

Here’s the challenge they faced:

Marine Layer couldn’t effectively manage its inventory, mainly during seasonal change, before 2020. Moreover, the planning team has a system incorporating labor-intensive manual reporting involving a 10-tab spreadsheet for inventory and sales tracking. Hence, this made it incredibly difficult to keep up with the retail scenario.

Adopting NetSuite Planning and Budgeting (NSPB)

In early 2020, Marine Layer finally shifted to NetSuite Planning and Budgeting. Put simply, it aimed to enhance demand planning customized for the apparel industry (in collaboration with Promethean Analytics).

Following the challenges they faced in 2020, Marine Layer now can examine and revamp inventory management strategies. The dynamic features helped the company to adapt to evolving supply needs very effectively.

Benefits achieved:

- Top-notch accuracy in inventory management.

- Perfect data alignment with more significant company metrics and goals.

- Comprehensive, in-depth insights about customer behavior and sales.

- Saves time in inventory management tasks and reporting.

Marine Layer, therefore, now plans to expand the use of NetSuite Planning and Budgeting across all products and sales channels.

Summing it up

Organizations of almost every size, from budding startups to business giants, have made a swift move and shifted to NetSuite. Why? The reason is simple. Financial planning and forecasting needs updated, robust data every time. In other words, NetSuite Planning and Budgeting helps companies collaborate, share and collect data that matters most when discussing increasing visibility and sound decision-making.

Want specific NetSuite Planning and Budgeting advice when you’ve hit a roadblock? Why not connect with our NetSuite consultants? They are eager to solve your queries. Book a free consultation now!

Frequently Asked Questions

1. How can I implement NetSuite Planning and Budgeting?

You should follow these three steps to implement NetSuite Planning and Budgeting. Firstly, evaluate and identify your organization’s specific planning and budgeting needs. Next, you will need to gather and organize all relevant financial data and information to input into the system. This includes historical financial data, forecasts, and any other relevant data points. Finally, you will need to provide training and support to your team members who will be using NetSuite Planning and Budgeting to ensure a smooth transition and effective utilization of the system.

2. How much does NetSuite Planning and Budgeting cost?

Different users subscribe for an annual license fee for the same. The license is composed of: Core platform, Optional modules, and the number of users. Additionally, there is a one-time implementation fee required for the initial setup. You can gradually activate and add users as your business grows steadily. That’s the beauty of Oracle NetSuite Planning and Budgeting cloud service.

3. How can I use NetSuite Planning and Budgeting to improve my forecast accuracy?

There are a number of ways for the same:

- Centralized location for storing and managing data. This ensures accuracy and full up-to-date data.

- You can automate several manual tasks in forecasting.

- You can improve your forecast accuracy through direct access to real-time data.